By Robert Bradley Jr. – February 14, 2025

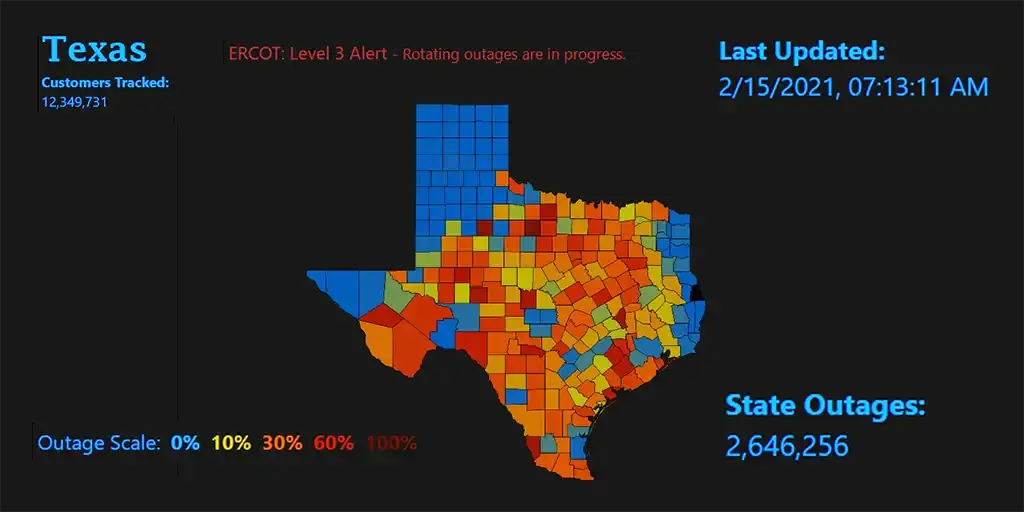

Ed. Note: Four years ago, Storm Uri caused Texas Texas wholesale electricity (ercot) market (ercot) WARNINGS on the wind/solar confidence of the state. The main media involved natural gas, instead, do not explore why why. Instead of deregulation, Texas has chosen to add wind, solar and batteries, while subsidizing natural gas plants to counteract intermittency. This duplicate grid is now Driving rates above in a state that could have depended on the surplus of natural gas.

It was not so much the story of the strange climate that triggered a written market failure. It was a classic application of the political economy of government intervention: what is seen and invisible, expert/regulatory insufficiency, and unwanted consequences.

Don Lavoie, a preeminent thinker in the field of market planning against the government, once warned:

If the guide agency has less knowledge than the system that is trying to guide, and what is worse, if their actions necessarily result in unwanted consequences in the operation of that system, then what is happening is not to plan at all , but rather, rather, rather, rather, blind interference of some agents with the plans of others. ” [1]

Planned chaos, in other words.

The failure of government electricity in Texas humiliated many experts in electricity design (including Technocrat Lynne Kiesling); the Texas Public Services Commission (PUCC); the Texas Electrical Reliability Council (ERCOT); and the Texas Legislature. Other remote players were the Federal Energy Regulatory Commission (FERC), North American Electric Confiability Corporation [né Council] (NERC); and National Association of Regulatory Services Commissioners (NARUC).

Classic liberals can link experience with the theory to identify expert/regulatory insufficiency. This should not be surprising since electricity is the most regulated industry in the United States next to money and banking and hiring of national defense.

Superficial view

The vision of the “main current” is that an “extreme tail event” caught private sector companies, mostly in natural gas, without preparation. The regulators, in the most part, did their job. I have challenged this interpretation in detail here and here. “Renewables, which represent more than a quarter of Texas’s generation capacity,” I argued, “”almost disappeared at the beak.

But there is a very important second part of the history: the price driven by wind driven severely compromised the economy of existing and new natural gas and natural gas plants.

But the rare event was not a market situation that would beg for market reform. It was a government situation in which the inertia of the intervention resulted in a greater intervention: wind/solar continuous, battery storage and even talk about the responses on the demand side (meters and incentive technology). Experts can solve this, in other words, with many studies and planning.

Enron analogy

This reminds me of interpretation (superficial) Enron. Enron made bad investments, tried to cover them and lost market confidence. They declared bankruptcy and “the market worked.” Why mass failure? Fish rots in the head, a book concluded. But because?

With Enron (as with the blackout), I maintain that something older was at work. Was ‘Countercapitalism,‘The search for unwanted, in the form of evasive rental rental, Strategic deception (‘Philosophical fraud’, without prosecutable fraud), and imprudence That Adam Smith, Samuel Smiles, Ayn Rand and Charles Koch, among others, have warned.

For me, at least, to get to ‘why behind why’ explain a ‘systemic failure’ as Enron opened a lot of deep thought that tested and expanded my theory. Capitalism was not to blame for Enron considering all the warnings of our side about bad commercial behaviors, and the same for electricity in Texas in February 2021.

Reinterpreting the support

With Texas, the explanation of the surface of the wind and solar energy almost disappearing in the beak is just the beginning. (“This was expected by planners, they can’t blame them.”) It was a general lack of climate among natural gas companies from well to the energy plant. But why? Reliability is work 1 with electricity, and this work was subcontracted to regulators who work with a weakened/fragmented industry. Coordination problems in abundance!

The “Because behind why” it reaches a lot of regulation and political/social pressure that took out the worst of the private sector parties. Think about the planned and involuntary consequences of the forcing of the Government of Wind Energy in particular. The intermittency of the wind and the negative price (of the federal tax) ruined the economy of conventional power plants.

With respect to coordination (bad), federal and state regulation has disaggregated the natural gas industry in three phases, and the same for electricity in three/four phases. There are no ‘electricity specialties’ or ‘natural gas specializations’ that are integrated vertically and horizontally (the forced regulation of industry). We needed specialties, in fact … (the commercial integration strategy (“oil specializations”), by the way, was part of the response to the “problem of common goods” of oil and gas production under the ‘capture rule ‘.

Electricity is different, they say. It needs large control areas due to the nature of electrons. A ‘common goods problem’ says Lynne Kiesling. Well, then, who do you trust? Markets or experts/regulators? And no, there is no Hayekian/ Central Planning solution of private resources in ‘Commons’ electricity.

Experts have been working hard on market design to find the correct balance between reliability and price. Texas had practically all prices (thinking that the maximum prices for several weeks of the year would compensate for not having ‘capacity payments’ to be ready to meet the maximum demand). But the shortage during URI’s storm sent prices to astronomical levels, which will now result in a lot of lack of payment, demands and probably the socialist extension of costs among all customers. Total disorder, and most regulators involved have resigned and have judicial dates.

———————

On Facebook, Lynne had a revealing exchange with economist Steve Postsel:

APATATE: According to the data I have seen, Ercot constantly plans reserve margins lower than other grids. Ercot now plans for 15-20%, but that is still lower than surrounding networks.

Kiesling: Reserve margin: In contrast to their interpretation, I would say that other RTO (PJM in particular) have excessive reservation margins in relation to the requirements of the supply and in relation to the capacity of the demand to respond to higher prices. Other RTO (PJM in particular) are governed by generators, who clearly have an incentive to have higher reserve margins than necessary. I tell you again: What do you think the cost is a reserve margin to achieve a 100% reliability during an extreme tail event of 1 every 20 years ??????

APATATE: As I pointed out in its other publication, the decision to accept blackouts like these (in extreme freezing) since the cost of doing business cannot be ruled out as optimal policy, given the cost of incremental reliability. Presumably, this would be a good topic for cost-benefit analysis with reference to the degree of public risk aversion. But “excess” reserves in other places, if they are adequate to mitigate the consequences that are currently felt in Texas, do not seem as heavy as obviously super optimity.

It is a big planning problem: reliability versus price. Experts (such as Kiesling) should tell regulators what to do. No, we cannot let the market decide because it is a “problem of common goods.” But I say: Deregulate let the electricity specialties enter the market … And, unless, at least understand the “coordination problem” as an expert/regulatory failure, not a market failure.

It is time for a business discovery process in a true market, not an artificial market under mandatory open access. Companies must be allowed to internalize the reliability function with their corporate guarantee of grade A. Many laws must be repealed, another history.

———————

[1] Don Lavoie, National Economic Planning: What is left? (Cambridge: Ballinger Publishing Company, 1985), p. 95.

———————

Appendix: Reinterpretation of Blackout de storm uri

My publications in the great Texas blackout:

The wind, solar energy and the great blackout of Texas: guilty as loaded

Natural gas “failed in the market” of renewable energy in Texas

Electricity planning: physical versus economic (an exchange with Eric Schubert)

Ercot “worked as planned” (architect Hogan does not give a quarter)

Civil Society and Natural Gas during the great Texas blackout

For other publications:

Numbers and the great Texas blackout (Bill Peacock: March 4, 2021)

ERCOT: A government planning government agency

Texas’s renewable failure: also remember Georgetown’s new green treatment

Oklahoma’s undulating blackouts: remembering the war against the coal of Audrey McClendon (Charlie Meadows: February 23, 2021)

Wind subsidies help freeze Texans (Bill Peacock: February 18, 2021)

Texas wind layer: Will the negative price blow the lights? (PTC versus new reliable capacity) (Josiah Neeley: February 17, 2021)

Related

Discover more Watts with that?

Subscribe to send the latest publications to your email.

#Market #failure