In this blog, we will discuss an important aspect of the export trade, which is the refund of IGST (Integrated Tax of Goods and Services) of Customs. Understanding GST reimbursement (goods and services tax) in export trade is crucial for both new exporters and existing.

As you know, there are two ways to execute an export shipment: “Without the payment of duty, that is, under the bond or letter of commitment [LUT]”And the other is” with the payment of duty, that is, IgST “.

Since exports have a zero rating under GST, both methods entitle GST reimbursements. In the first method, you will receive a reimbursement of the unused entrance tax (ITC) of the department of GST. In the second method, you are eligible for a reimbursement of the amount paid from IgST of the Customs Department.

In this blog, we will focus on the refund process under the second method, that is, Customs IGST reimbursement. We will provide a brief general description of this method, we will discuss the procedure to obtain IGST reimbursement, we will address possible errors made by exporters and how to rectify them, explore how to track the IGST refund state and finally discuss a crucial clause related to IgST reimbursement that many exporters may not take into account. Read the blog until the end for an integral understanding. Let’s start!

Export in the payment of duty – Method 2 – Brief explanation

As we discussed above, there are two types of methods to execute export shipments. The second type is “to export with the payment of duty, that is, in the payment of IGST”. Let’s understand this guy through an example.

For example, if the cost of its exported goods is 20 Lakhs, and IGST is applicable to 18%, which amounts to 3 Lakh 60 thousand. When you present your GSTR 3B statement, you must make this payment using your accumulated entry tax (ITC) or in cash.

Once you have paid the 3 Lakh 60 thousand IGST, it is eligible for a customs refund, and this refund is directly accredited in its bank account. We will discuss this procedure in detail in the next section.

In general, companies with higher export supplies compared to national supplies accumulate ITC, and these companies must opt for the second method to ensure that the accumulated ITC is reimbursed in cash directly to their bank account.

How to claim IgST refund?

Now, it is possible that you have several doubts in mind regarding where to submit the request for reimbursement, what documents are required, why the IGST reimbursement comes from customs instead of the department of GST, etc.

The answer to this is that IGST reimbursement is processed through an automated system, and it is not necessary to present a separate application. Your shipping bill itself serves as a request for reimbursement. This is because IGST reimbursement is receiving due to the export activity, and once it presents the shipping invoice, it is confirmed that the goods are being exported.

Look at the following video in Hindi in which we will briefly explain the second method, that is, Customs IgST refund. Then, we will discuss the procedure to obtain the IGST reimbursement, possible errors made by exporters and how to rectify them, how to track the IGST refund state and, finally, an important clause related to the IGST reimbursement that many exporters may not take into account.

https://www.youtube.com/watch?v=ksxnml9zxhm

Understand the IGST refund mechanism

Now, let’s understand how the automated IGST reimbursement works.

When you run an export shipment, you present a shipping bill with customs. All details of the shipping invoice, such as SB no, date, invoice No. date, invoice value, amount paid of IGST, port code, etc., are stored in the Icegate customs database.

Then, when all the details of the export offer in GSTR 1/Table 6A, such as SB no, date, invoice, date, invoice value, amount paid of IgST, port code, etc., etc., etc., all this information is stored in the GSTN database.

Subsequently, when GSTR 3/3B presents and pay the amount of IGST, GSTN transmits this information to the Icegate database. The Icegate database coincides with its information with the data received from GSTN at the invoice level. If all the details coincide perfectly or validate, an IGST reimbursement displacement is generated. Otherwise, it shows an error. We will discuss different types of errors and how to solve them in the next blog section.

In order for IGST reimbursement to be processed automatically, three important conditions must be met:

- The export shipping invoice must be presented with customs.

- The EGM (General Export Manifesto) for the shipping bill must be presented.

- A valid statement must be filed in GSTR 3 or 3B.

[If You are also an Importer and have still not applied for EPR Registration and are confused whether your Company requires it or not, Please check our blog on this, which also explains the entire process of Registration on CPCB Portal – Who needs EPR registration and What is the Process?]

If the IGST refund pending some shipping invoices? – How to identify and solve errors?

Now, in many cases, exporters make mistakes in the presentation of change or in the presentation of the shipping bill, which leads to an mismatch between the details of return of GSTN and the details of the customs shipping invoice. Consequently, the reimbursement is stuck.

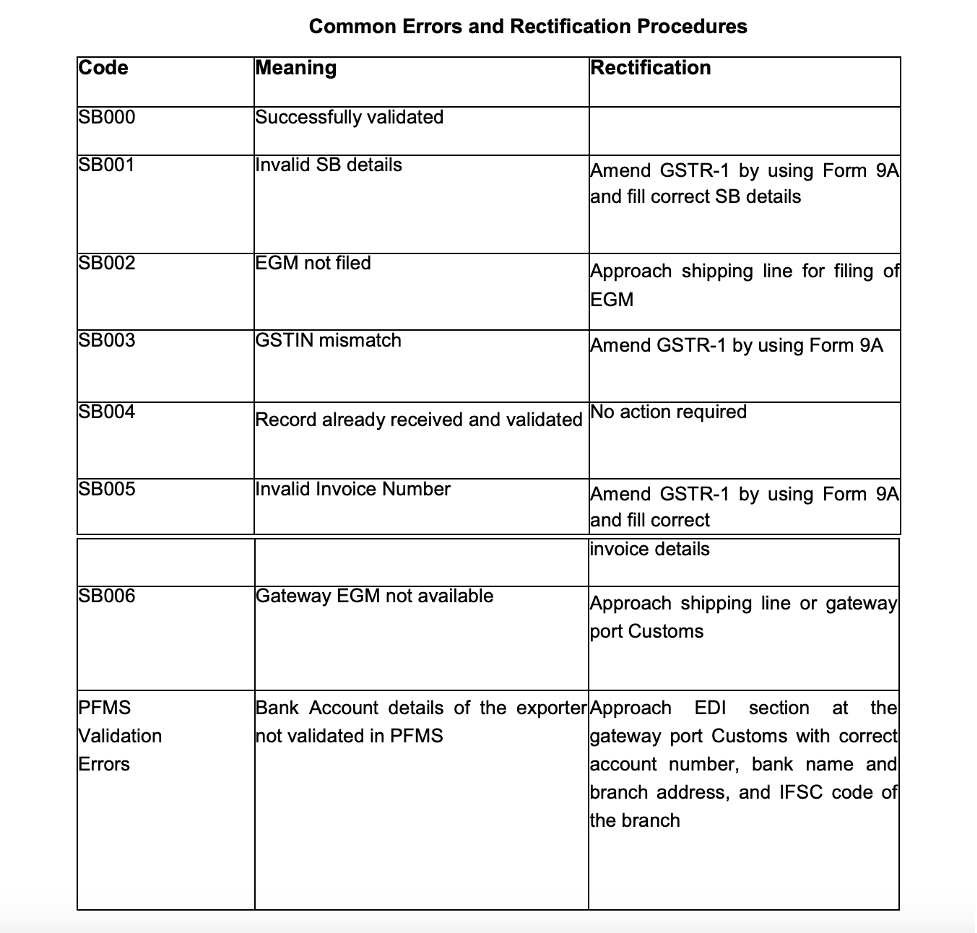

In the image, you can see a list of all error codes, what these errors mean and how to solve them.

Here, SB000 means that everything is fine, and you should receive reimbursement. The most common error is SB005, often caused by exporters who use different invoices for GST and customs purposes due to lack of knowledge. This results in a mismatch between the invoice No. transmitted by GSTN and the invoice No. in the shipping invoices, which triggers the SB005 error.

In some cases, even after SB000, the reimbursement could get stuck due to two main reasons. First, there may be an alert in the IEC in Customs, and second, there may be a PFMS validation error.

I hope the table is easy to understand and act. In the next section, we will discuss another important reason that can make the reimbursement get stuck and how it can solve it.

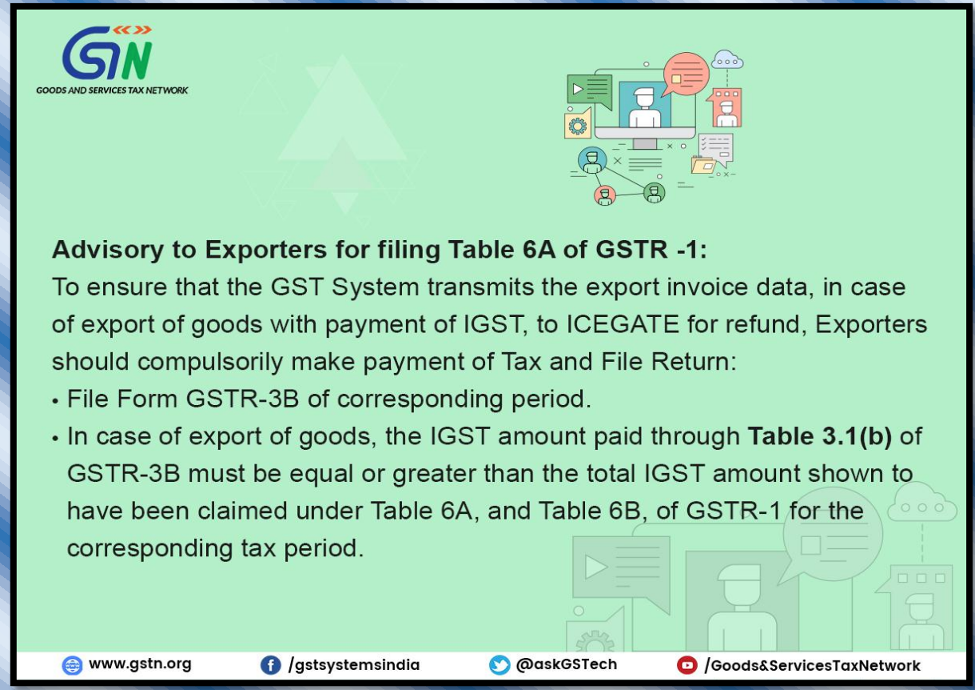

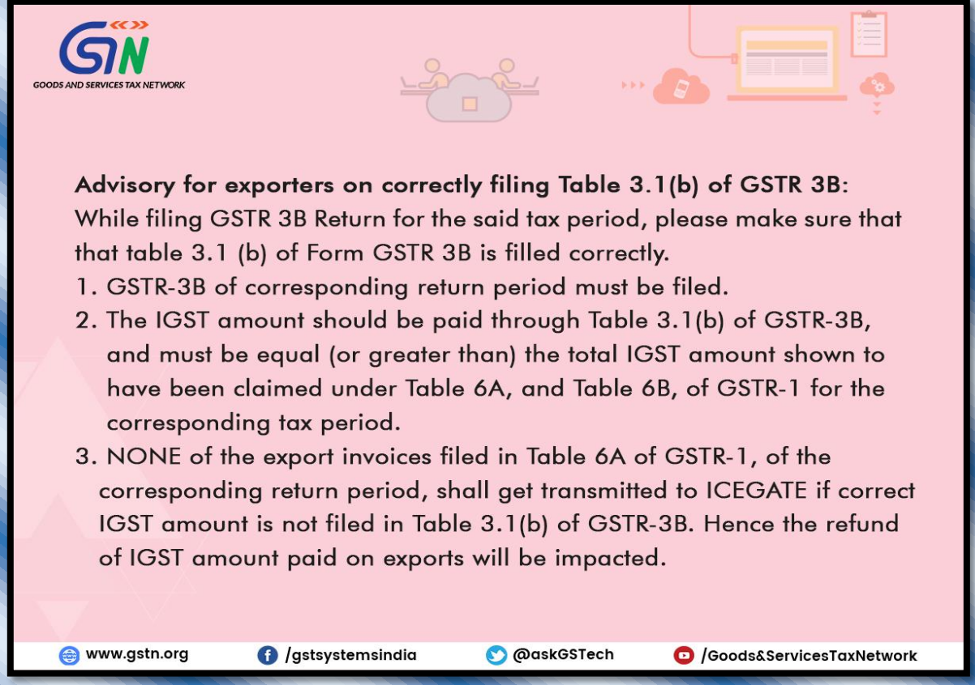

No transmission of GSTN shipping bill

Another important problem that causes the delay in IGST reimbursement is the non -transmission of the details of the GSTN sending invoice to Icegate. In this case, GSTN does not transmit the details, which makes it impossible to coincide and delay the reimbursement process.

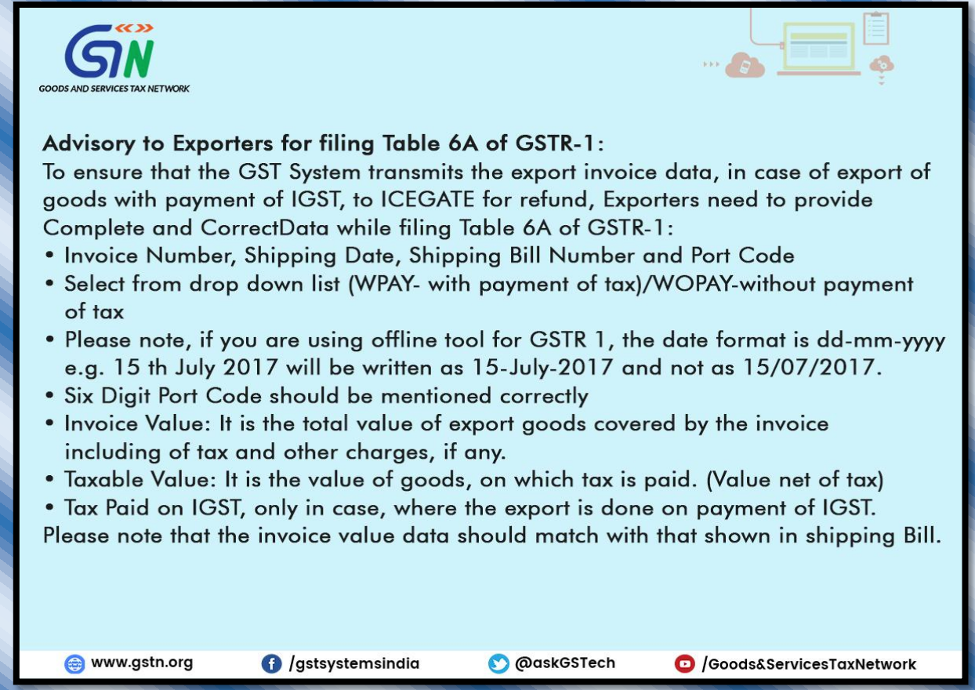

Keep in mind that the reason for the non -transmission of shipping invoices is only an error when presenting returns. You can see a notice on the screen that will guide you to file the statements correctly.

The most common mistakes are the discrepancies between the details GSTR1/Table 6A and GSTR 3B. This could be due to incomplete details for all invoices in Table 6 or not updating all invoices in Table 6a.

Another common error could be that the IGST paid in Table 3.1 (b) of GSTR 3B is less than the total IGST claimed in Table 6a of GSTR1 for the same period. The claimed amount cannot exceed the real amount of IGST.

Carefully check all these warnings and make sure there are no errors in exchange for presentation.

[Not sure whether your company is taking all the Export incentives notified by the Govt? – Refer to our article on “18 latest Export promotion schemes/Export Incentives in India“]

How to track IgST’s refund state?

Then, the next question that may arise is how you will know what mistakes exist and if the details of the shipping invoice have been transmitted or not.

The first step is to log in to the Icegate website and verify the IGST validation status. This will show any error that exists, and must take the necessary actions to solve those errors.

If the details of your shipping bill are not shown in Icegate, then you must log in to the GST portal. According to the refund section, select the “Status of monitoring of the invoice data that will be shared with Icegate”.

Here, you will find a list of all failed invoices that have not been transmitted from GSTN, along with their reasons. You must take the necessary measures to solve them.

Important clause for IGST reimbursement on the export of goods

CBIC introduced a new sub-rule, that is, Rule 96B, on March 23, 2020.

According to this rule, if you do not realize the foreign currency in an export shipment within the period of time prescribed by RBI under FEMA (which was 9 months and, due to COVID, extended to 15 months), then you must pay the amount of IGST with interest within 30 days after the expiration of said period. The interest rate is set at 18% per year.

This is a crucial clause with respect to IgST’s reimbursement and is also applicable to the unused ITC reimbursement.

Who are we and why choose igst pending reimbursements?

If your reimbursement is stuck for any shipping invoice, contact us. With our extensive experience in GST and Customs, we have successfully helped exporters to obtain IgST reimbursements for more than 5,000 shipping invoices, to date.

Before concluding the blog, I would like to provide information about AFLO Group. AFOO Group is a specialized company that meets all export and import needs. We offer DGFT and Customs Consulting Services, specialized in the load forwarding, and we also participate in the purchase/sale of Rodtep/ROSCTL/DFIA licenses.

We have helped numerous new exporters/importers to start and execute their export/import shipments. Our experience covers DGFT, Customs, Banking, Logistics, Export Incentives, Legal Assistance and more. Do not hesitate to contact us directly by phone [+91-9321890890] or email [info@afleo.com] For any consultation.

Do you have doubts? Complete the following form to contact us.

Notice: Javascript is necessary for this content.

Our presence on YouTube

#IgST #Refund #pending #export