Hello friends,

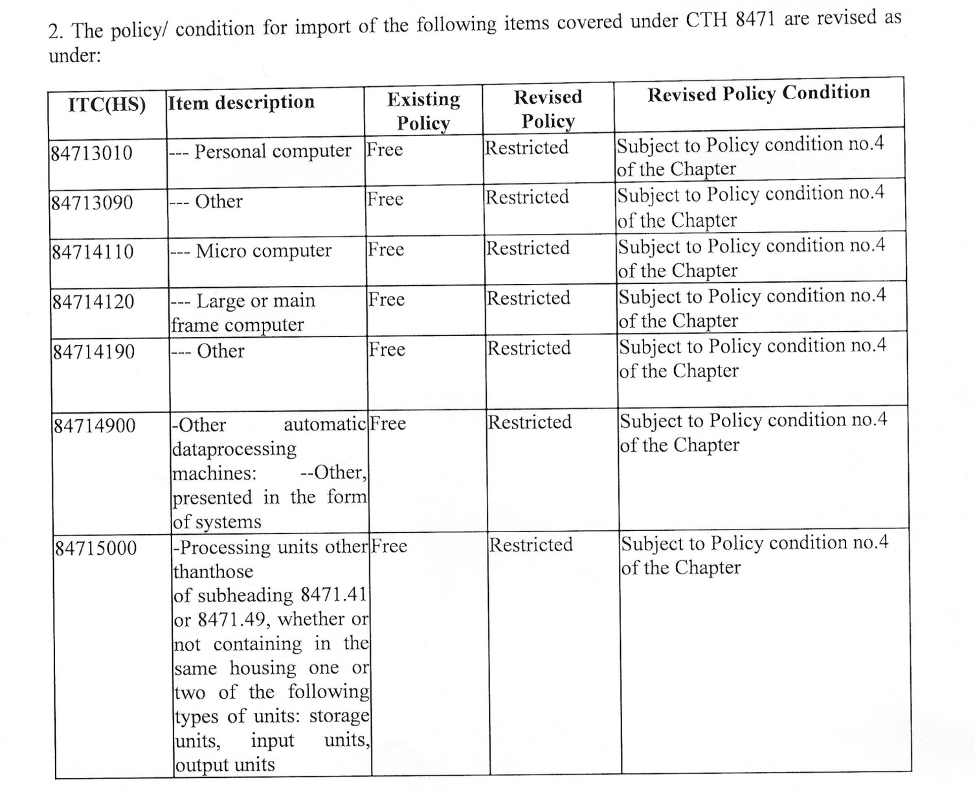

As you know, DGFT has reclassified the importation of laptops, tablets, personal computers all in one, factor computers of ultra small form and servers that fall under HSN 8741 of the “free” to “restricted” category. This movement has been made to promote national manufacturing.

This means that now the importation of these products to India will require a “restricted import license”, which will be issued by the DGFT headquarters in New Delhi.

Initially, DGFT had announced this change to have an immediate effect, but after significant chaos, it has now been decided to implement it from November 1, 2023. This implies that any clear import before October 31 will not require an import license, but shipments that arrive from November 1 must request a compulsive restricted import license.

Exemptions provided

The following exemptions for imports have been provided:

- Imports of only a unit of laptops, tablets, PCs, etc., through post or courier are exempt from the requirement of a license.

- Exemption is also granted for importation of up to 20 articles for consignment for purposes, such as research and development (R&D), tests, comparative evaluation, evaluation, repair and re -export, and product development. Import without a license is available only for these specified purposes, with the condition that once the purpose is met, the company must destroy the product or re -export it.

- If a product is sent abroad for repair and then imports again, it will not require a license.

- In addition, if laptops, tablets, PCs, etc., serve as essential parts of capital goods, are also allowed to import without license.

See the image to obtain a list of products with your 8 -digit HSN codes to which these new conditions will be applied.

Additional exemptions according to the latest notification

DGFT has issued some additional exemption criteria in its latest notification No. 38 dated October 19, 2023:

- The articles manufactured in special economic zones (Sez) can be freely imported to the National Rate Area (DTA) without the need for a restricted import authorization. However, activities such as packing again, labeling, renewal, tests and calibration will not be considered manufacturing activities within Sezs.

- Private entities that supply central or state governments for defense or security purposes are also exempt from obtaining a restricted import license.

- Exemption is granted for the repair, return or replacement of IT hardware that was previously sold, as well as for the retenting of said articles repaired abroad, on a basis for self -autrtification.

- The Sez Units, as well as the units that operate under the export -oriented units (EOU), the Software Technology parks of India (STPI), the electronic hardware technology parks (EHTP) and the biotechnology parks (BTP), are also exempt from the import license requirements, provided that the import is only for the consumption of the units.

- The importation of spare parts, pieces, assemblies, subset and components associated with IT hardware devices is also exempt from the requirement of a license.

Look at the following video in Hindi that explains the new process to import laptops, tablets, personal computers, servers, etc. In India. It will give you an idea about the required documents, the time frame, the exemptions provided, etc.

https://www.youtube.com/watch?v=mtpnyyedxn4

Application process and required documents

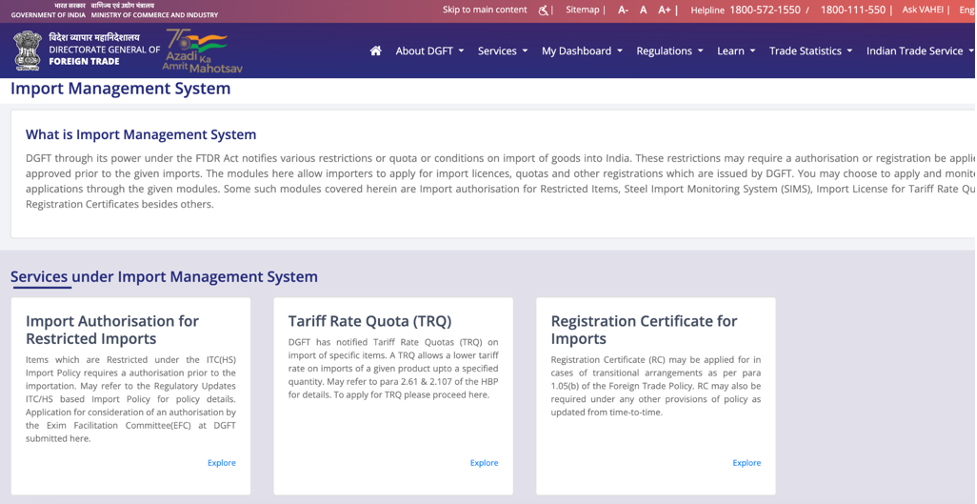

According to the last circular number 06 of October 19, 2023, the General Directorate of Foreign Trade (DGFT) has introduced the import management system for the importation of IT hardware.

To initiate the application process, applicants must request online on the DGFT website. According to the image provided, applicants must select “import authorization for restricted imports” under the import management system to begin the application process.

When presenting the application, you must provide some basic details:

- Select the import article and indicate whether or not you are renewed.

- Specify the country of origin, quantity and CIF value of the imported article.

- Provide details of imported articles under license in the last 3 years of license.

- Indicate the sales/billing details of the previous 3 years.

- Select the import and purpose port port, as for real or real use.

It is important to keep in mind that importers can request multiple authorizations, and all authorizations will be valid until September 30, 2024. It can modify the number of items in their authorization at a given time, but the general CIF value cannot be changed.

[If You are an Importer and have still not applied for EPR Registration and are confused whether your Company requires it or not, Please check our blog on this, which also explains the entire process of Registration on CPCB Portal – Who needs EPR registration and What is the Process?]

In AFOO Group, we specialize in obtaining DGFT restricted import licenses, and we can help you throughout the documentation process and link work. Do not hesitate to communicate with us for any of your requirements. If you have any questions or question, do not hesitate to comment, and our team will be happy to help you.

Thank you.

Do you have doubts? Complete the following form to contact us.

Notice: Javascript is necessary for this content.

Our presence on YouTube

#Obtain #restricted #import #license #laptopstabletscomputersservers