Welcome to this week’s edition of Let’s Talk, where we immerse ourselves deeply in the financial strategies that can make or break the success of their small business.

Directing a small business means using many hats, but one of the most unbuming responsibilities is to administer its finances and taxes effectively. The difference between companies that prosper and those that simply survive is often reduced to intelligent financial planning and strategic tax management.

This week, our financial expert panel shares the internal strategies used by the successful owners of small businesses to keep more money in their pockets. From fiscal deductions often overcome to cash flow optimization techniques, these are not only theoretical concepts: they are practical and processable strategies that can immediately implement to strengthen the financial bases of your business.

Let’s talk!

More episodes of talking about speaking

Write for dynamic businesses ✍

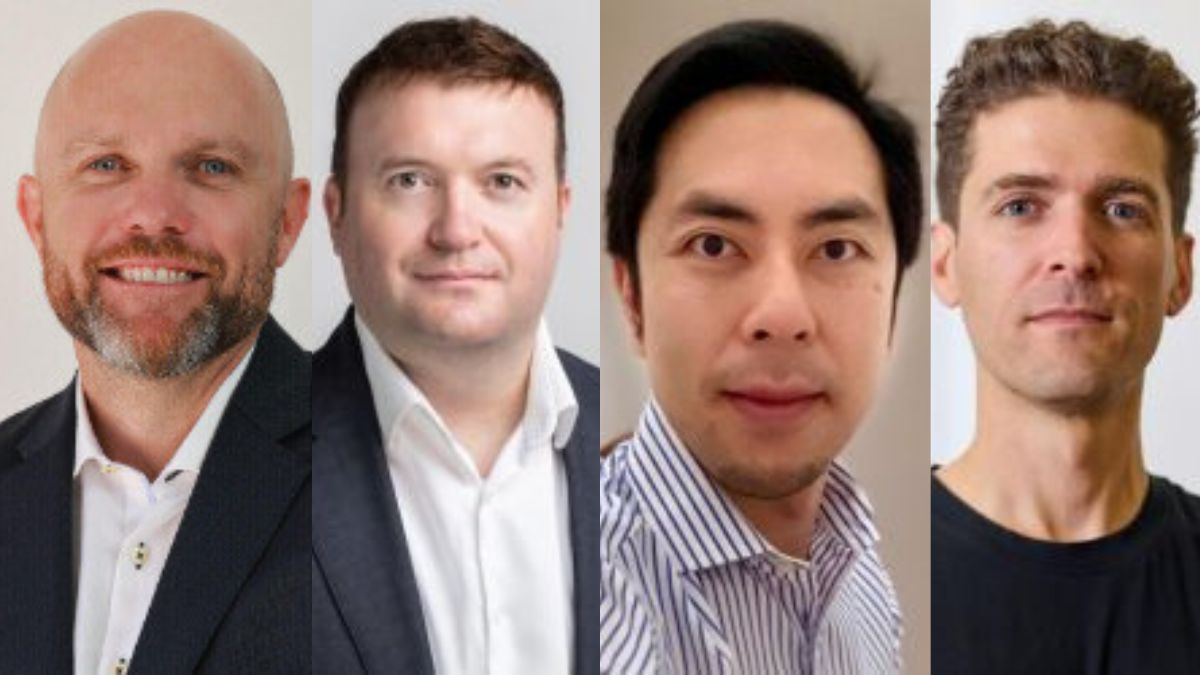

Scott Wiltshire, vice president and general manager, Oracle Netsuite Anz

“For small businesses, the intelligent money administration is reduced to three central strategies: improve visibility, processes automation and stay ahead of compliance.

- Get real -time visibility in your operations: Too many companies make decisions based on outdated or incomplete information of having disjointed systems or manually reconcile spreadsheets. The use of a cloud -based system that consolidates all its finances, operations and informing a unique vision helps business leaders to see where money is being won and lost, so that they can make smarter and faster decisions to improve cash flow.

- Automatize routine tasks: Automation reduces errors, accelerates processes and allows staff to focus their time on added value activities that generate income. When AI is integrated into these systems, not only automates basic concepts such as billing and payroll, but also surface ideas and recommendations on where to reduce costs or invest more effectively.

- Stay complying with reducing tax burdens: Fiscal and regulatory obligations can be expensive if they are not properly administered. The automation of financial processes helps guarantee precise records, the preparation of optimization lines for electronic audits and provides immediate access to details at the transaction level. This makes it easier to plan tax liabilities, identify eligible deductions and avoid fines of the Australian Tax Office (ATO).

“In essence, saving money is about building commercial resilience. With the correct technology foundation, small businesses obtain more clear information, a stronger cash control and the ability to reinvest in growth.”

Nick McGrath, CEO, Moneytech

“For small businesses, fiscal planning should not only be compliance, it is about making your money work more intelligent. Think of it as a cash flow tool. A simple movement such as bringing deductible expenses or using instant asset writing to update the equipment can help reduce taxable income and fuel growth in business at the same time.

“Take the financing of invoices, release effective that is stuck in unpaid invoices so that it has liquidity to cover invoices or invest before the end of the year. Commerce finance offers similar flexibility, whether they buy more actions for the business or negotiating better terms of suppliers, with often deductible taxes when structured in the right way.

“And it is not just tax time. Having a flexible credit line means that it depends less on short -term expensive loans and better equipped to handle seasonal ups and downs. It is about maintaining cash flow so that you can take advantage of opportunities when they arise.

“From our perspective in Moneytech, the busiest businesses are those who think about cash flow and tax planning together, not as separate exercises. It is a change in the mentality that can really bear fruit.”

Alex Molloy, co -founder and CEO, Valiant Finance

“With the right strategies, small Australian companies can navigate an increasingly challenging financial landscape and significantly improve their results and ensure better financing opportunities.

“Tracee to maximize your tax deductions: to claim legitimate deductions, you need a record of it. From the expenses of the vehicle to technological purchases, the maintenance of exhaustive records guarantees that it is not leaving money on the table. Many SMEs lose thousands in deductions simply due to poor documentation.

“Addressing ATO debt: with recent legislative changes, ATO debt is no longer tax deductible, which increases the true cost of unpaid obligations by 25% for most companies. The general interest charge of ATO is composed daily with 11.17%, which makes immediate criticisms. Prioritize refinancing or debt of the ATO of the ATO before other financial obligations.

“Recilia your finances regularly: clear financial records allow better decision making, reduce the risk of auditing and position their business as” financing “when growth opportunities arise. In the current selective loans environment, preparation is everything.

“Explore flexible loan options. Not all commercial loans have to be blocked in a fixed structure. Flexible finances such as a credit line or a commercial cash advance linked to your sales can give your business a cash flow buffer when you need it most. A corridor can help you compare these options and match it with adequate for your situation.”

Charles Liu, owner / marketing manager, cubic promotion

“A strategy often overlooked for small businesses is to use the cancellation of instant assets not only for large ticket machinery, but also for everyday operational tools. Laptops, ergonomic office furniture or even storage shelves can qualify, which increases productivity while reducing taxable income.

“Another advice is to pay in advance the expenses before June 30. Many small operators do not realize that they can claim 12 months of insurance, rent or professional memberships in advance, immediately reducing this year’s tax invoice while soften the cash flow.

“For companies that supply at the national level, load consolidation is a hidden saver. Working with the emails for lots of lots reduces costs and also reduces carbon emissions, something increasingly valuable when tender contracts.

“Finally, consider the uniforms of the personnel and merchandise of the brand. They are deductible taxes, they are doubles such as marketing and eliminate the need for employees to claim work dress separately. It is a practical way of keeping their brand in the mind while saving at the time of taxes.

“Proactive thinking beyond obvious deductions ensures that every dollar saved returns to growth.”

Scott Wiltshire, vice president and general manager, Oracle Netsuite Anz

Scott WiltshireVice President and General Manager, Oracle Netsuite Anz

For small businesses, intelligent money administration is reduced to three central strategies: improve visibility, processes automation and stay ahead of compliance.

- Get real -time visibility in your operations: Too many companies make decisions based on outdated or incomplete information of having disjointed systems or manually reconcile spreadsheets. The use of a cloud -based system that consolidates all its finances, operations and informing a unique vision helps business leaders to see where money is being won and lost, so that they can make smarter and faster decisions to improve cash flow.

- Automatize routine tasks: Automation reduces errors, accelerates processes and allows staff to focus their time on added value activities that generate income. When AI is integrated into these systems, not only automates basic concepts such as billing and payroll, but also surface ideas and recommendations on where to reduce costs or invest more effectively.

- Stay fulfilling to reduce tax burdens: Fiscal and regulatory obligations can be expensive if they are not administered properly. The automation of financial processes helps guarantee precise records, the preparation of optimization lines for electronic audits and provides immediate access to details at the transaction level. This makes it easier to plan tax liabilities, identify eligible deductions and avoid fines of the Australian Tax Office (ATO).

Discover we talked about commercial issues

Stay up to date with our stories in LinkedIn, Twitter, Facebook and Instagram.

#fiscal #deductions #completely #missing #small #businesses