To remain competitive in foreign markets, Indian exporters need the best technology, efficient machinery and optimal cost of production. But the costly nature of importing capital goods often becomes an obstacle for most companies. This is where the Export Promotion Plan for Capital Goods (EPCG) comes in handy.

Initiated by the Government of India in terms of the Foreign Trade Policy (FTP), the EPCG scheme provides exporters with an opportunity to import capital goods at zero customs duty or on concessional terms. By reducing the initial investment in technology and machinery, it makes industries competitive in a global environment.

In this blog, we will discuss the benefits, eligibility, conditions and challenges of the EPCG scheme, as well as practical advice on how exporters can best utilize this powerful scheme.

What is the EPCG scheme?

The EPCG scheme, controlled by the Directorate General of Foreign Trade (DGFT), allows Indian exporters to import capital goods for pre-production, production and post-production with zero customs duty or on concessional terms. The main objective is to promote technological updating, improve production quality and increase global competitiveness.

For a detailed description of the EPCG scheme and its features, see our Complete EPCG Scheme Guide

EPCG Program Eligibility:

- Manufacturer exporters (direct exporters).

- Commercial exporters linked to supporting manufacturers

- Service providers involved in export-related services (e.g. hotels, hospitals, logistics).

By utilizing this scheme, the machinery procurement cost for exporters can be reduced drastically while meeting the export requirements stipulated by the DGFT.

Important advantages of the EPCG scheme for exporters

Savings on capital goods rights

One of the biggest advantages of the EPCG system is that customs duties on imports of capital goods are reduced or waived completely. For the exporter, this means enormous savings in terms of investment from the beginning. Instead of investing excessively in import duties, companies can use funds for operations, marketing and expansion.

Improves export competitiveness

Reduced production costs allow Indian products to be sold at competitive prices in the international market. Exporters with advanced machines and modern technology can offer superior quality at low prices, establishing themselves firmly in the international market.

Improved cash flow management

As the EPCG scheme eliminates the monotony of advance payment of tariffs, exporters are in a better liquidity position. This cash flow flexibility allows companies to manage working capital more efficiently, maintaining smooth daily operations and without financial pressures.

Technological modernization and updating

The plan simplifies the process of acquiring world-class machines from anywhere in the world. Facilitating upgradation of production machinery improves efficiency, reduces wastage and makes Indian exporters quality conscious as per global standards.

Encourages MSMEs and Startups

For startups and MSMEs, the EPCG scheme is particularly useful. They do not have the means to invest in expensive machinery. Small players can easily expand their operations, innovate and increase exports with lower or no import duties.

Benefits of the EPCG plan compared to other export incentives

India has a wide range of export incentive schemes like Drawback, Advance Clearance, RoDTEP (Remission of Duties and Taxes on Export Products), RoSCTL (Refund of State and Central Taxes and Levies),

While these programs offer tax rebates or post-export incentives, the EPCG aims to reduce upfront costs by allowing duty-free imports of capital goods. This differs from other programs in that it strengthens the exporter before production compared to after production.

Conditions to enjoy the benefits of the EPCG program

Although the EPCG system is very rewarding, the exporter must meet certain conditions:

- Export Obligation: Exporters must fulfill an export obligation equivalent to six times the duty saved within six years from the date of issuance of the license.

- Sectors covered: Available for manufacturers, traders, exporters and service providers in various sectors.

- Permitted capital assets: Plants, machinery, equipment and spare parts used in manufacturing and export.

Find out more about the export obligation under the EPCG scheme and how to comply with it.

Failure to comply with these requirements may result in sanctions and therefore exporters should plan their obligations carefully.

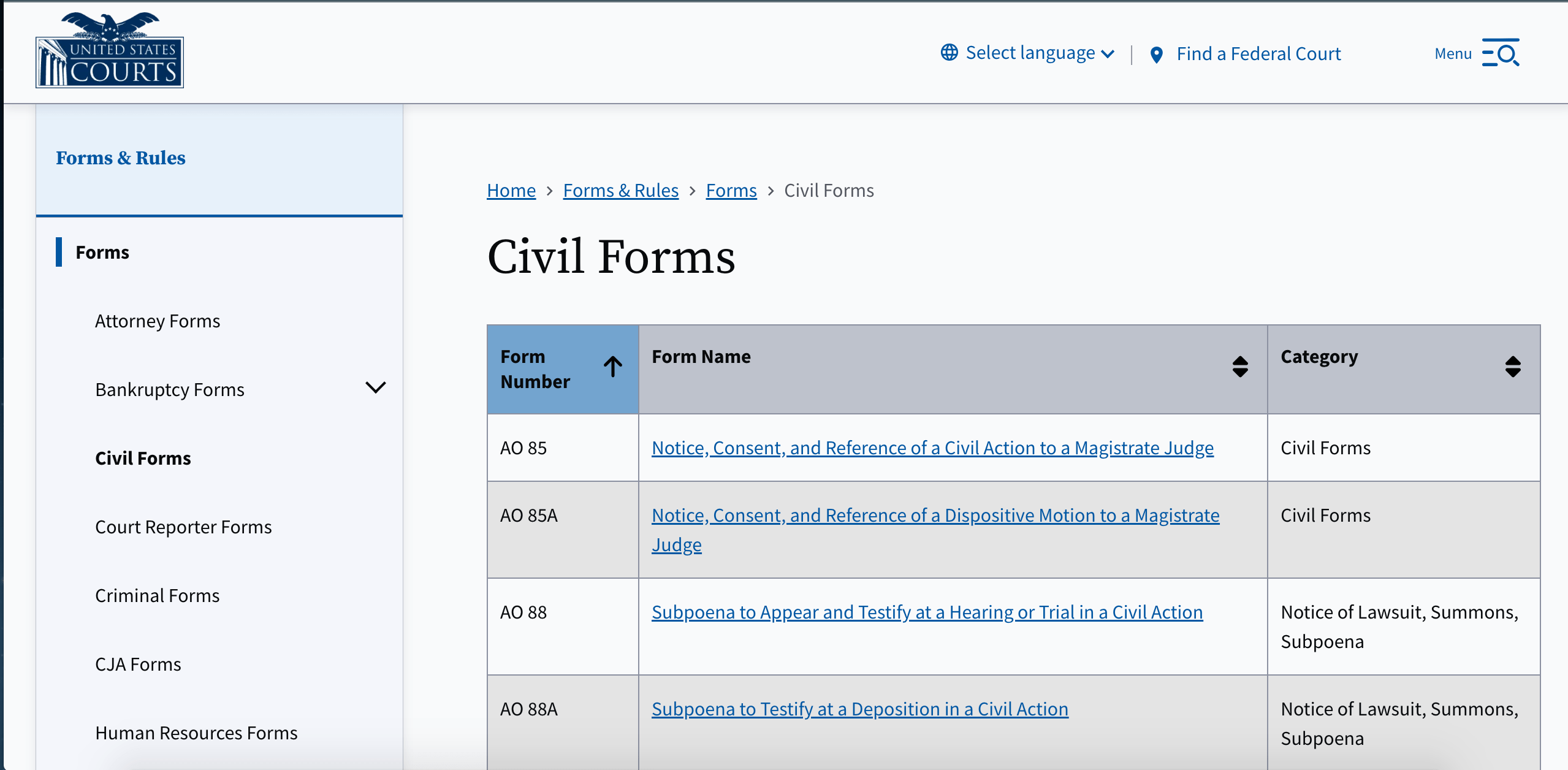

Documents required for EPCG license

You will need these documents to obtain the EPCG license, including:

- Import and Export Code (IEC)

- Panoramic Card

- proforma invoice

- Digital signature

- GST Registration Certificate

- MSME/Industrial Registration Certificate

- Brochure

- Registration and Membership Certificate (RCMC)

- Original self-certified copy of the public accountant certificate

- Original self-certified copy of the chartered engineer certificate

Common problems when obtaining EPCG benefits

Despite its benefits, companies often face challenges:

- Compliance issues: Lack of information or negligence in following up on export commitments can lead to sanctions.

- Documentation and Procedures: The process requires excessive documentation and DGFT procedures, which are difficult for new applicants. Inaccurate or incomplete records of import and export transactions, or lack of export information on shipping invoices

- Penalties for non-compliance: In case the export obligation is not met, exporters can be asked to refund the duties saved along with fines and interest.

- Non-presentation of the Installation Certificate:Submission of the Installation Certificate of imported machinery to the Regional Authority (RA) within the required period.

- EO extension issue: Delays in reporting to DGFT and in requesting extensions of the Export Obligation Period (EOP).

For hassle-free compliance and avoiding penalties, explore our guide on EPCG Scheme Compliance

How to Maximize EPCG Plan Benefits for Your Business

To get the maximum benefit from EPCG, exporters must follow a structured approach:

- Understand eligibility clearly: Please validate your company’s eligibility before applying.

- Accurate documentation – Maintain adequate records of capital goods imports, as well as export obligations.

- Timely request – Submit applications to the DGFT at the appropriate stage of your business planning.

- Regular compliance monitoring – Track export performance to ensure compliance is achieved.

- Professional assistance – Collaborating with professionals like Afleo Group ensures hassle-free EPCG license application, maintenance of compliance, and fulfillment of export obligations.

Frequently asked questions about EPCG program benefits

Exporters must achieve export results equivalent to six times the duties saved over a six-year period.

Failure to comply with obligations may result in repayment of the saved rights along with interest and penalties.

Yes, EPCG benefit can be availed along with other export incentives such as duty drawback, RoDTEP and RoSCTL, subject to the conditions laid down by the DGFT.

The plan aims to ensure that capital goods can be imported with lower duties, provided exporters meet their export obligations.

The EPCG license usually has a duration of 24 months for imports and 6 years for compliance with export obligations.

Manufacturer-exporters, merchant-exporters who have association with (supporting manufacturers) and some service providers are eligible.

Although the scheme is not interest-based, penalties for non-compliance may consist of interest on the amount saved in entitlements.

Direct exporting allows companies to interact with international buyers, develop broad brand recognition and maintain higher profit margins.

Conclusion

The benefits of the EPCG scheme make it a very powerful weapon in the hands of Indian exporters. By reducing import duties on capital goods, it is easier for companies to upgrade, save costs and improve competitiveness abroad.

For exporters, particularly MSMEs and startups, EPCG offers the economic headroom and technological advantage to succeed abroad.

If you are planning to apply for the EPCG program or need guidance on compliance, Afleo Group is here to help. With years of experience in DGFT services, Afleo ensures exporters maximize benefits from EPCG and other trading schemes with ease.

Contact Afleo today to apply for the benefits of the EPCG scheme and accelerate your export growth.

Do you have any questions? Please complete the following form to contact us.

Notice: JavaScript is required for this content.

#Benefits #EPCG #scheme #exporters