In this blog, we will discuss the period of export obligation (EOP) or the export obligation [EO] Extension under the EPCG scheme.

The need for an EOP extension arises when it cannot fulfill its export obligation within the time frame of 6 or 8 years.

Especially due to the impact of Covid [Corona Pandemic]Many companies have not been able to fulfill their obligations within the stipulated period of time.

In this blog, we will cover issues such as the duration of the EOP extension, how many times can be extended, the associated rates, and particularly, we will deepen the COVID relaxation notifications. We will discuss these notifications with practical case studies to provide a clear understanding. Then, let’s start.

Different types of authorizations of EPCG and its extensions EO

The EPCG licenses issued under the EPCG scheme of concessional work, with tax rates of 3% and 5%, come with a period of export obligation (EO) of 8 years.

For zero work EPCG scheme licenses issued after 2012/13, its EO period is established at 6 years.

EPCG licenses with an 8 -year period are eligible for 2 EO extensions, each 2 years, totaling 4 years. Therefore, the total EO period for such licenses becomes 12 years (8 + 4).

EPCG licenses with a 6 -year period are eligible for 2 EO extensions, each 1 year, totaling 2 additional years. This results in a total period of 8 years (6 + 2).

It is important to keep in mind that DGFT regional offices cannot grant extensions more than 12 years or 8 years, respectively. For additional extensions, you must approach the EPCG committee in New Delhi.

[If you’re unfamiliar with the EPCG Committee and its role, please go through our detailed blog on the EPCG Committee. In the blog, we explain what the EPCG Committee is, how it processes different case types, and other related concepts – EPCG Committee DGFT Delhi]

For the extensions granted under the EPCG scheme of zero work, there are government rates or composition rates involved. These rates amount to 2% of the proportional duty saved on the export obligation not fulfilled for each year of extension.

Watch our brief YouTube video to understand this topic in detail. It covers the concepts such as the duration of the EOP extension, how many times it can be extended, the associated rates, and particularly, the COVID relaxation notifications for the EPCG scheme with practical examples in Hindi.

https://www.youtube.com/watch?v=uxlkqxwl3-y

COVID relaxation notifications under the EPCG scheme

DGFT issued a total of 3 relaxation notifications to provide relief and extensions in the export obligation period (EO) for EPCG licenses owners due to COVID pandemic.

The first notification was PN 67 dated March 31, 2020. The second was notification No. 28 dated September 23, 2021. The third was PN 53 dated January 20, 2023.

In the image, we have simplified the explanations of these three notifications. An important note to keep in mind is that the relaxation provided by PN 53 is available only if you have not yet taken advantage of the benefits of PN 67 or notification 28. In addition, PN 53 has specific terms and conditions for the headline holders of EPCG licenses in the hotel Medical and educational care sectors, which you can consult.

| Mr. No. | Notification No. and date | GIVEN RELAXATION | Conditions |

|---|---|---|---|

| 1 | PN 67 dated. March 31, 2020 | If the export obligation period expires between February 1, 2020 and July 31, 2020, then the period will automatically extend for 6 months. | Additional rates will not be paid. |

| 2 | Notification No. 28 dated. September 23, 2021 | If the original or extended export obligation period expires between August 1, 2020 and July 31, 2021, then the EO period will be extended until 31.12.2021. | There are no composition rates. However, additional 5% will be imposed in terms of value [FFE] on the obligation to export equilibrium. |

| 3 | PN 53 dated. January 20, 2023. | The EO period can be extended from the expiration date, for the number of days, the existing period of an authorization falls within 01.02.2020 and 31.07.2021. |

|

Understanding these notifications may not be simple, so in the next section, we will explain them using practical examples of case study.

Practical example to understand Covid relaxations under the EPCG scheme

As we discuss in the first section of this blog, for the Zero Work EPCG schemeThe initial export obligation period (EOP) is 6 years, and can take two extensions of 1 year each according to existing policy provisions. Then, the total EOP becomes 8 years (6 + 2).

Relaxations related to COVID add to the regular extensions that it can take according to the provisions of the policy.

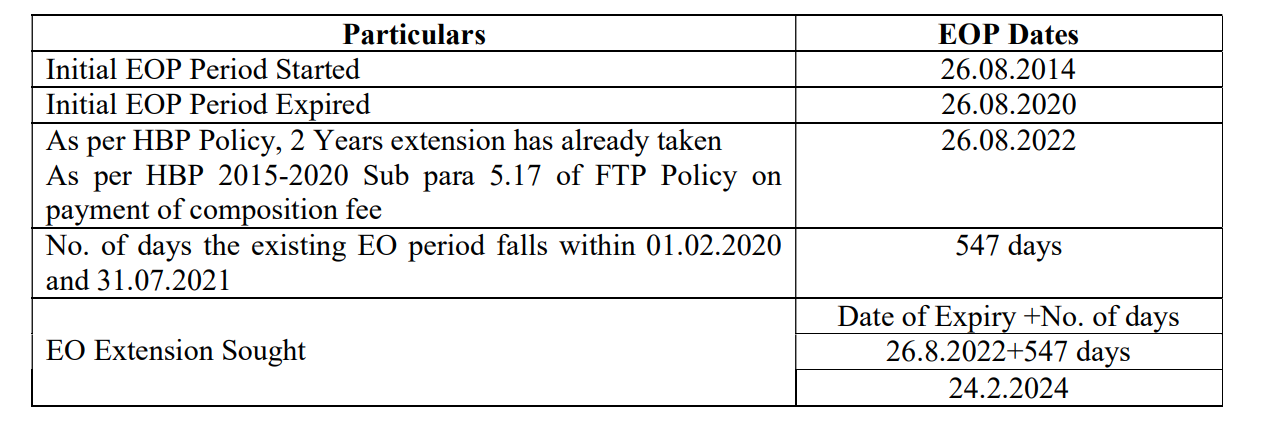

Now, let’s understand this with an example. Consider that you have an EPCG license of zero service dated August 26, 2014, with an initial EOP of 6 years.

As shown in the image, you can see that the initial EOP will end on August 26, 2020. After that, when paying composition rates, it can take an extension of 2 years until August 26, 2022.

Here, keep in mind that it has not taken advantage of the benefit under PN 67 and notification 28. Therefore, it is eligible to take advantage of the benefit under PN 53.

According to PN 53, the number of days falling within the initial/extended period from February 1, 2020 to July 31, 2021 is exactly 547 days. The reason behind this is that due to the impact of Covid, we lost 547 days, which were part of our existing EO period. Then, DGFT is giving an extension of these lost days.

Consequently, the final extension for this specific license would be until February 24, 2024 (26.08.2022 + 547 days) = 24.02.2024.

I trust this example clarifies the concept.

Who are we and why choose us?

We in Afoo Group, we are a DGFT team and customs experts who have a rich experience of more than 10 years in exim consultancy & International Logistics [Freight Forwarding] And I also deal in Buy/Sell/Rodtep/ROSCTL/DFIA License With our vast knowledge and experience in this field, we can represent your case for all activities related to the EPCG scheme: application/extent of redemption/EOP and obtain it in a problem. We are well equipped to handle global trade logistics with efficiency and experience. Let us manage logistics while focusing on growing your business. Contact us today to get more information about how we can help you rationalize your supply chain and increase your final result. We are dedicated to providing efficient and profitable logistics services to help our customers.

Therefore, contact us for any of your requirements and our team will be happy to help you.

We ask you to share this information with your other friends in the industry, commercial associations, since this information could also help them.

[Not sure whether your company is taking all the Export incentives notified by the Government? – Refer to our article on “18 latest Export promotion schemes/Export Incentives in India“]

Do you have doubts? Complete the following form to contact us.

Notice: Javascript is necessary for this content.

#Export #obligation #period #EOPEO #Extension #EPCG #scheme

![[Botany • 2025] Begonia chunxiuensis (Begoniaceae, section Platycentrum) • A new species from Guangxi, China](https://thenewshub.website/wp-content/uploads/2025/12/Begonia_chunxiuensis-novataxa_2025-Wang_Tian_Li_Xi-150x150.jpg)