An endowment is a legal trust structure in order to create a fund that raises donations to continue the mission and operations of non -profit organizations such as hospitals, universities, museums.

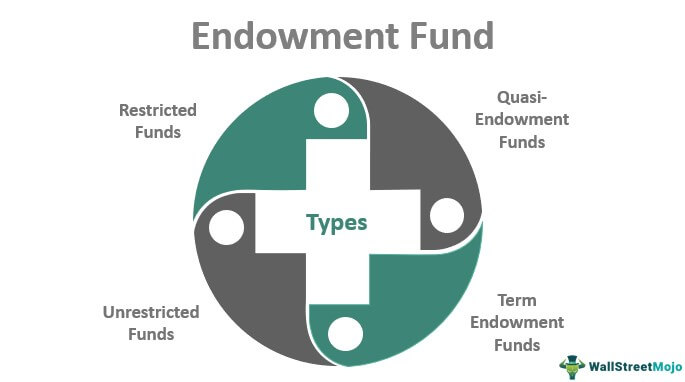

What are the three types of endowments?

When your non -profit organization is considering using the endowment structure? It is appropriate that your team of investment advisors, counters and lawyers work together to discuss the type of structure or type of endowment structure is appropriate for the needs of your organization. Here are the three types of endowment structures and how they are used. According to the Board of Financial Accounting Standards (FASB), these are the details of the three types of endowments.

Term endowments

A term endowment is not perpetual, it is organized and financed by a specific period of time. This may pass years or up to a specific completion date specified in the endowment documents. Term endowments can often begin when a donor death occurs or when a document establishes. After the period of time or expiration, the total amount can be used to start financing operations.

True understanding

A real endowment begins with the donor who provides funds to the endowment and specifying that the funds must be kept in perpetuity. A written agreement is used to facilitate the financing and future use of the income of true endowments.

Quasi-endowments

The board of directors of endowment funds votes on the best use and deployment of funds with its advisors. This includes choosing reserve funds, making gifts without restrictions to other organizations and implementing new funds from unforeseen donation. The inclusion is at the discretion of the board of directors of an endowment. This means that the Board can choose whether the new funds can be placed in a new fund or include in a quasi background in the endownment.

Endowment management

The administrators of endowment funds and non -profit managers work very closely with one, to ensure that the allocation investment objectives are met and maintained. The administrator of the endowment fund is well obliged and a fiduciary. The deployment of funds by investment management will work to assign appropriate investment assets. Maintain the investment objectives and policies of the endowment.

Endowment financing

The endowments are mainly financed by relying on public donations. A “main” donated amount is invested in assets producers of income that may include bonds, capital shares and other appreciators. And later, the income of these assets is used for operations and other uses stipulated by the trust documents and discretion of the Board of Directors.

Some disadvantages of the use of the endowment include: Some donations can only be used for limited purposes. Perhaps there are also some limitations or restrictions on the endowment trust documents that prevent the funds from withdrawing or used for operations. That depends on the fund agreements.

Advantages of using endowment funds? Financing a endowment trust can lead to non -profit organizations to finance a mission and its operations. Not to mention be able to invest donations in order to finance programs that help and improve communities or causes.

Did you catch my article about “The Ultimate Guide to Trusts” click here?

The greatest non -profit endow of the year 2021

The National Education Statistics Center lists the largest endowment trust funds below, and HERE.

In conclusion, I hope you have learned some basic concepts about why and how non -profit organizations use endowments for the needs of their organizations. This publication is intended to communicate the uses and what are only for public educational purposes. Thanks for reading.

JS

#Basics #endowment #fund #Investor #financial #writer