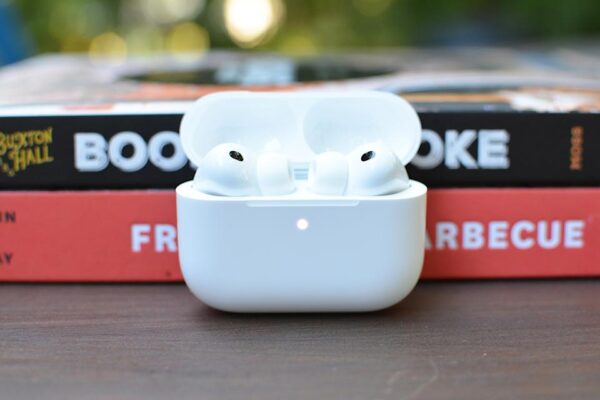

AirPods Pro 3 are $40 off right now at Amazon

If you have not yet updated to Apple’s AirPods Pro 3You can purchase the company’s latest model at a discount through an offer on Amazon right now. The AirPods Pro 3, which went on sale in September, currently cost $210. That’s $40 off and just $10 more than the record price we saw last week….