The great tax bill, which the US Congress is currently working to approve, changes the popular deduction of the 199A section. At this point, if the new deduction of the 199A section of Big Beaut Beauty 199a of the house becomes law or not? An open question.

The great tax bill, which the US Congress is currently working to approve, changes the popular deduction of the 199A section. At this point, if the new deduction of the 199A section of Big Beaut Beauty 199a of the house becomes law or not? An open question.

But can you plan how this new deduction will work in your situation? This brief blog post explains mechanics.

To give you an overview of the image here at the beginning? The two main features of the new deduction formula are (1) fiscal savings are a bit larger. And then (2) for business owners with limited deductions due to wages or W-2 status as a specified services or business trade, limitations are more slowly eliminated.

The processable vision here: if the law is approved, you want to verify its deductions now larger and better in the 199A section are optimized.

New formula applies to fiscal years from 2026

An important first note? Big Beautiful Section 199a applies to fiscal years as of December 31, 2025.

In addition, the new 199A Deduction section is permanent. (The current version essentially expires at the end of 2025.)

The percentage increases from 20 percent to 23 percent

The deduction percentage increases from 20 percent to 23 percent.

Example 1: The deduction formula of the original section gave a taxpayer with $ 1,000,000 of commercial income qualified a deduction of $ 200,000 (potentially.) The deduction of the Big Beautiful 199A section gives that taxpayer a deduction of $ 230,000 potentially.

Note: There is a limitation for both the original and the new version of the deduction of the 199A section. Taxpayers obtain that 20 percent or 23 percentage of deduction in the lessor of their qualified commercial income or in their ordinary (therefore No Long -term capital gains or qualified dividend) taxable income.

Different phase-in limitations

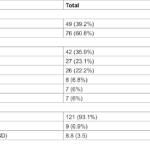

Both the original and the new version of the 199A section limit the deduction for taxpayers with taxable income above a threshold amount based on W-2 wages, the non-adjusted base (before depreciation) of depreciable property, and then based on the fact that trade or business falls into a specified services trade or a business category such as medical care, law, consulting, and so on. (People call these SSTB).

But the new law changes the “speed” at which the limitations occur. This decreases the marginal tax rate paid by these limited taxpayers. (According to the current formula, the marginal tax rate in the worst situations can address 70 percent). Mechanically, how this is confusing. But essentially the taxpayers calculate two amounts of deduction of the 199A section and then use the minor amount as their attempt.

Note: We have a simple JavaScript calculator here, “the Big Beautiful Section 199a calculator”, which you can use to make the calculations. But maybe I finished reading this publication to understand what is happening with the formulas.

Step 1 in the new section 199a limitation calculation

The first step to determine the deduction of the 199A section? The formula calculates the deduction of the 199A section that looks only at the qualified commercial income.

Calculate this first potential deduction of the 199A section as the lessor of 23 percent of the qualified commercial income or as a “limited” amount based on W-2 salaries and the original cost of depreciable property. (This is the same formula as in the original version of the 199A section. The formula limits the deduction to the greater than 50 percent of the company’s W-2 wages or 25 percent of the W-2 wages plus 2.5 percent of the company’s depreciable property using the non-adjusted base immediately after the acquisition). But let’s work on a real example.

Example 2: Thomas, a single taxpayer, has two businesses that earn $ 1,000,000 a year: a farm and a law firm. The farm pays $ 300,000 of wages and uses $ 400,000 of depreciable machinery. Therefore, the first version of the formula ignores the law firm because it is a specified trade trade or business. Just calculate the deduction of the 199A section on the farm. This non -SSTB deduction is equal to 23 percent of the $ 1,000,000 of qualified commercial income ($ 230,000) … or the highest of 50 percent of wages ($ 150,000) or 25 percent of wages ($ 75,000) plus 2.5 percent of the $ 400,000 of machinery ($ 10,000) SO $ 85,000 in total. Therefore, the deduction of the 199A section that is not SSTB is equivalent to $ 150,000.

Step 2 in the new section 199a limitation calculation

The second step to determine the new 199A section of deduction works like this. The formula tentatively calculates the deduction of section 199a as equal to 23 percent of all qualified commercial income of NO SSTBS and SSTBS. Then, this version of the formula limits this deduction if a taxpayer’s taxable income increases above a threshold amount. Specifically, the formula remains an adjustment equal to 75 percent of the amount by which the taxable income exceeds the elimination threshold of the 199A section.

In 2025, the year before the Big Beautiful Section 199a, the deduction enters into force, the threshold amount is equivalent to $ 197,300 for individual archivators and $ 394,600 for married files. Approximately then, in 2026, the threshold amounts should match $ 200,000 for individual archivators and $ 400,000 for married archivators. (If the large tax bill is approved, the treasure will probably provide the real threshold numbers of 2026 at the end of 2025.), but we only work in an example using my conjectures on the threshold amounts next year.

Example 3: Again, Thomas has two businesses, a farm and a law firm. Both earn $ 1,000,000 a year. The second version of the deduction of the 199A section, therefore, is equivalent to 23 percent of the $ 1,000,000 of agricultural income ($ 230,000) plus 23 percent of $ 1,000,000 of income of the law firm ($ 230,000) … so they are $ 460,000 … The formula subtracts 75 percent of the taxable income that Thomas wins in the excess of the Single file. If that threshold is equal to $ 200,000 and its taxable income is equal to $ 1,000,000 due to other deductions that claims? The excess is equivalent to $ 800,000, calculated as $ 1,000,000 minus $ 200,000. The adjustment amount is equivalent to 75 percent of the excess of $ 800,000, or $ 600,000. This adjustment of $ 600,000 in zero effect the second version of the 199A Deduction section that matched $ 460,000.

In the end, the limited deduction Big Beautiful Section 199a is equal to the largest calculation results of the two version: $ 150,000 or $ 0. And that means a deduction of the 199A section equal to $ 150,000.

Dividends of the Commercial Development Company now Qualified Income

A final adjustment. The new Big Beautiful Section 199a deduction treats the dividends of choosing the qualified business development companies of section 851 as qualified commercial income, so in the same way that Reit dividends are treated. Therefore, this income produces a deduction from the 199A section.

About inflation adjustment

And a postdata: when I asked Chatgpt to review my draft for this publication, he suggested that he indicated another adjustment: the new law restores the base year for inflation adjustments to 2025 so that taxpayers do not lose several years of CPI increases. That is a good point.

#Big #Big #Beautiful #section #199a #deduction