Guest “Bravo Sierra!” By David Middleton

During the opening speech of President Trump, he promised to unlock the “liquid gold” under the feet of the Americans and increase the production of fossil fuels. He suggested that doing so would reduce gasoline prices and lead to American wealth in cascade. In his executive order to declare an “emergency of national energy,” he ordered the Department of Energy to resume the processing of GNL export authorizations and prioritize the development of LNG in Alaska.

There is no real “energy emergency”, at least not in the sense that Trump means. Under former President Joe Biden, the United States was already pumping records of oil and gas. And the growing evidence suggests that Trump’s plan to maximize LNG exports will really achieve the opposite of their declared objective: two January reports show that the US exports of the USA will increase. The national gasoline prices, with most of those GNL profits are clarified abroad in the coffers of foreign investment companies, with particular advantages for China.

LNG money goes to foreign investors

The first report, of the Interested parties of private capital, He discovered that a surprising proportion of US gnl profits. UU. It goes to foreign investment companies. The researchers found that 14 investment companies, from eight foreign countries, have financed 11.5 billion cubic feet per day in the US LNG exports capacity. USA in 2023.

[…]

Note for Mrs. Nolan: This is how private capital works. I do not have the time or inclination to verify exactly who financed the construction of the seven GNL export facilities currently or the five that are currently under construction. However, who financed the construction generally reaps much of the profits until the financing note is paid. Regardless of the poorly informed opinions of the Bravo Sierra Club, the export capacity of North America will be more than double during the second mandate of President Trump in office.

The vast majority of this export capacity will be along the coast of the Gulf of the United States and will export natural gas produced from oil and gas fields located in the United States and the Gulf of America. If LNG exports increased prices, I would have already done it.

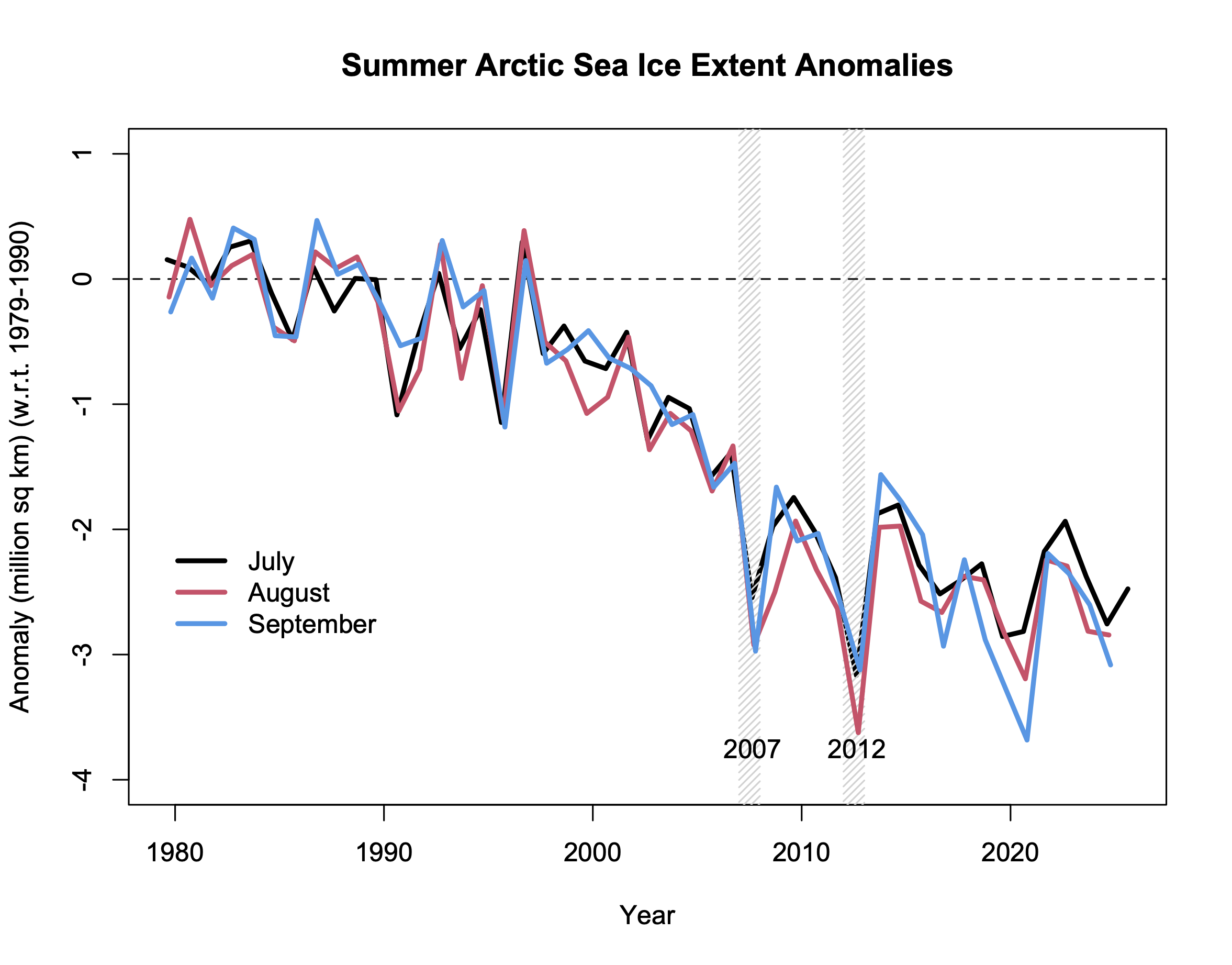

From 1997 to 2012, the United States consumed more natural gas than we produced and the average price was $ 4.76 per thousand cubic feet (MCF). Since 2013, we have produced more natural gas than we consumed and the price averaged $ 3.35/MCF. If we get the Anomalously high prices in 2022would have averaged around $ 3.00/mcf.

The United States can afford to be a net exporter of natural gas because we produce more than we consume. This works to keep the lowest prices. If LNG exports were restricted or prohibited, it would temporarily crash the prices of natural gas. Drilling would be reduced, production would decrease and prices would increase again.

What makes natural gas prices increase? Production or consumption has not increased.

Imported natural gas increases prices, because we are a net importer when we produce less than we consume.

But we will use all our reservations!

The crude oil and the US natural gas. UU. Proven reserves, end of the year 2022

With data for 2022 | Release date: April 29, 2024 | Next release date: April 2025

Oil Oil

- The oil condensate and the lease of Ce. UU.

- The production of Copencies of crude oil and the lease of the USA. UU. Increased 6% by 2022.

- In Texas, which has more crude and condensate reserves of lease than any other state, it showed that reserves increased 9% by 2022 (1.7 billion barrels), the greatest net increase in any state (Table 6).

- In New Mexico, the condensate of crude oil and lease showed that reserves increased by 26%, the second largest net increase (1.3 billion barrels). In northern Dakota he showed that reserves increased by 14%, the third largest increase (0.6 billion barrels).

- The greatest net decrease, 13%, in proven reserves of crude oil and lease condensate in 2022 was in California (225 million barrels) (Table 6).

- The average punctual price of 12 months, the first day of the month for crude oil West Texas Intermediate (WTI) in Cushing, Oklahoma, increased by 43%, from $ 66.26 per barrel in 2021 to $ 94.54 per barrel in 2022.

Natural Gas prominent

- The proven reserves of American natural gas increased by 10%, from 625.4 TCF at the end of the year 2021 to 691.0 TCF at the end of the year 2022, establishing a new record of reserves proven by natural gas in the United States for the second consecutive year (Table 8 ).

- Natural gas showed that Alaska reserves increased by 25% by 2022, which increases the total of that state of 99.8 TCF to 125.2 TCF, the greatest increase in all states in 2022.

- Texas had the second largest increase in proven natural gas reserves in 2022 (21.2 TCF, or 14%), and New Mexico had the third largest increase (9.9 TCF, or 27%).

- The average specific price of 12 months and first day of the month for natural gas in Louisiana Henry Hub increased by 71% by 2022, $ 3.67 per million British thermal units (MMBTU) in 2021 to $ 6.29/MMBTU in 2022 , which was the highest annual price since 2008.

- Operators in Pennsylvania reported the greatest net decrease in proven natural gas reserves in 2022 (652 billion cubic feet, or 0.6%).

- In 2022, US natural gas exports were 6.9 TCF, the highest registered volume.

Proven reserves They are estimated volumes of hydrocarbons resources that the analysis of geological and engineering data demonstrates with reasonable certainty is recoverable in existing economic and operational conditions. Reservations estimates the change from year to year due to:

- Price and cost changes

- New discoveries

- Exhaustive evaluations of existing fields

- Production of existing reserves

- New and improved technology and technologies

To prepare this report, we collect estimates developed independently of tested reserves with the EIA-23L form of a sample of American operators of oil and natural gas fields. We use this sample to even more estimate the part of the proven reserves of the operators that do not report. This year, we received responses from 397 of 404 sampled operators, which provided a coverage of approximately 90% of the proven oil reserves and 93% of proven natural gas reserves nationwide. We develop estimates for reservations located in the United States, each state individually and some state subdivisions. States and regions with subdivisions are:

- California

- Louisiana

- New Mexico

- Texas

- Federal Offshore Gulfo from Mexico

Related

Discover more Watts with that?

Subscribe to send the latest publications to your email.

#GNG #Bravo #Sierra #del #Sierra #Club