I am not a fan of real estate investment. I mean, of course, I believe that real estate investment probably belongs to the portfolios of most people. But you can do it efficiently by maintaining a mutual back or ETF index background.

I am not a fan of real estate investment. I mean, of course, I believe that real estate investment probably belongs to the portfolios of most people. But you can do it efficiently by maintaining a mutual back or ETF index background.

Some people can also bought the house or apartment where they reside. But after those obvious options? I am quite agnostic. Except, that is, for real estate investment that every entrepreneur must consider: owned by Auto-Alquiler that occupies their business.

Why the property of Auto-Alquilar is so attractive to entrepreneurs

Auto-Alquiler property works very well for entrepreneurs for a simple reason. As long as the rules follow, they can unlock the deductions of depreciation that normally other real estate investors cannot unlock. Or unlock without spending a lot of time or making a lot of violin.

By the way, a real estate professional can unlock depreciation deductions. But to do that, you will have to spend more than 750 hours and more than 50 percent of your time working in a real estate trade or business. They will also need to participate materially in the properties they have if they want to deduce depreciation, and this can be problematic.

And by the way? Short -term rental investors? Yes, they can also obtain giant deductions on their return. And they can participate materially with very modest hours. But they also need to administer the average rental interval of the guests. Why to qualify as a short -term rental investor? Its average rental interval must be equal to 7 days or less.

However, a self-aliler property? Easy for entrepreneurs if they do well.

The deduction of depreciation deduction of the owner of Auto-Alquiler

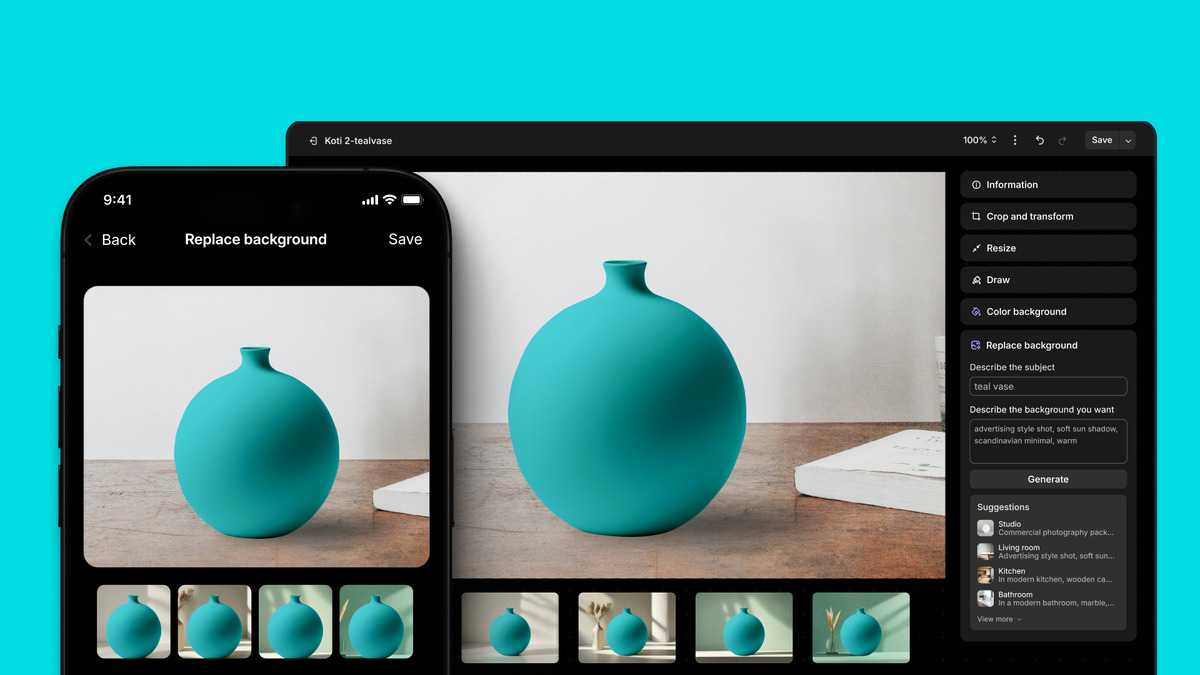

Take a look at JavaScript’s simple calculator below. It shows the deductions of depreciation that you can probably obtain from a commercial property occupied by the owner that costs $ 1,000,000. The calculator uses bonus depreciation numbers by 2024 and assumes that a cost segregation engineer has broken down the price in real estate and personal goods.

To summarize, once you click on the calculate button, the deduction deduction estimator of the property of Auto-Alquilar calculates the deductions of depreciation for the first year until the seventh year. These calculations represent a price of $ 1,000,000 broken down into 25% land, 15% of five years, 30% property of fifteen years, 0% 27.5 years of property and 55% property 39 years. And the assumption is the percentage of bonus depreciation is equal to 60%. What is the correct percentage by 2024. But what is unique here? Compared to most real Etado investors who No Use those deductions of depreciation of Gian? A businessman will most likely.

Advice: Replace the percentages or decimal values, with your possible real estate investment to estimate the real depreciation you can deduce in your performance. And then click calculate again.

Note: The depreciation of the seventh year is also barely The deduction of depreciation for years that follow the seventh year.

The usual problems with real estate depreciation and other deductions

The problem with those great deductions however? In many, perhaps most cases, you can’t use them. Section 469 of the Internal Revenue Code limits its deductions in a passive investment as real estate to the income obtained from other passive investments. (This is the usual rule for real estate investments, by the way).

However, something special happens with the property of Auto-Alquiler that the entrepreneur configures correctly. First, if the entrepreneur groups the rental property with the operating trade or the business? This group makes the rules of section 469 see the group of grouped rental and active trade or businesses as a real estate rental activity.

The second thing that happens? The entrepreneur analyzes the hours that passes both in the rental property and in the other active trade or business to determine if they participate materially. If more than 500 hours pass in the grouped activities? Bingo.

The first requirement to group rent with active trade or business

It has two requirements to make a group work. First, the property of the rental property must perfectly match the property of the other operational trade or business. For example, if two shareholders have 60 percent and 40 percent say an engineering company? They would also need to possess those same percentages, so 60 percent and 40 percent, of the building that the engineering company is rented.

Note: In general, it would put real estate in an entity, as a limited liability company. And treat that entity as an association. And then, the other operational trade or business could be a different association. Or a corporation.

The second requirement to group

You must make the group in the first year owner of the property or operate trade or business. For example, if this year, do you buy a building to accommodate the engineering firm that you and your partner have operated for decades? You must make the choice of grouping in this year’s tax declaration.

Note: Not all grouping and aggregation elections must be held in the first year, there is an activity or business or business. However, with the grouping elections of Section 469 as a self-aliler, the decision not to group the first year is a group by default. And then the problem you believe? It cannot regroup later, except in special circumstances. And then only with the permit of the internal tax service.

A predictable warning

Let me end with a predictable caution. One that you really don’t even need to give me. (I’m sorry. But counters have quite conservative and compulsive personalities).

The fiscal deductions you generate by buying a building and renting it to your business? Very high impact. You may in effect in effect hundreds of thousands of dollars before using this gambit. (In comparison, remember something like a plan of section 401 (K) on the stage absolutely better, it may allow you to save $ 70,000 of money before taxes).

But fiscal savings? Not so good, an entrepreneur can ignore the return on investment. Therefore, we want to deal with a possible real estate investment in the same way that we would deal with any other commercial investment. We probably want to calculate the return of early investment. Consider if we can use funds securely for some of the purchase price. Things like that.

#real #estate #investment #entrepreneur