E-BRC understanding: a vital document for exporters

An electronic banking certificate (E-BRC) is an essential digital document for export companies. Issued by a bank, the E-BRC serves as confirmation that the exporter has received the payment of the buyer for the exported goods or services. The details provided in the E-BRC or BRC are important economic and valuable sources of financial information or companies that seek export incentives under the foreign trade policy (FTP), presenting a valid E-BRC is mandatory, since it acts as proof of payment against exports.

We all know what an e-BRC is and how challenging it can be to obtain it by a bank. Banks often delayed the load of the E-BRC, made mistakes and often had little personal, causing significant difficulties to exporters. This resulted in a large amount of wasted labor, time and cost in monitoring banks to close the E BRC for each shipment.

However, with the new pilot launch of the updated E-BRC system introduced by DGFT according to commercial notification No. 33 dated November 10, 2023, exporters can now self-certify and broadcast the E-BRC. Yes, you heard that well. Exporters will no longer need to chase banks and can generate E-BRC from the comfort of their office.

What is E-BRC and why is it important?

The Electronic Banking Certificate (E-BRC) is an important certificate for exporters, which acts as evidence that the payment of exported goods or services has been made. It is an important aspect of export documentation and compliance with the Foreign Trade Policy (FTP).

[To know more about (FTP) Foreign Trade Policy you may refer to our article here – New Foreign Trade Policy 2023 – Brief Highlights ]

For those exporters who take advantage of government schemes, such as export incentives, the bank completion certificate is required. The DGFT portal captures all E-BRC data, which also serve to monitor commercial entries so that the government maintains transparency.

An efficient E-BRC mechanism minimizes compliance requirements and improves commercial operations.

| Feature | Traditional E-BRC system | U-BRC of Updated Autocertification |

|---|---|---|

| Processing time | It depends on the bank deadlines, often delayed | Immediate self -ocertification by exporters |

| Errors | Banks can make data entry mistakes | Exporters have total control over precision |

| Control | Exporters had to trust banks for broadcasting | Exporters generate their own E-BRC in DGFT |

| Convenience | Multiple follow -ups are required with banks | Digitally performed from the DGFT portal |

| Flexibility | There is no option for club or divide remittances easily | Exporters can club/divide IRM messages to generate e-BRC |

With this turn, exporters are not obliged to wait for banks and can produce E-BRC in DGFT with clicking a button, saving effort and time.

Step by step process on how to generate E-BRC

To carry out the E-BRC generation, do the following:

• Log in the DGFT portal: Access the DGFT E-BRC section and log in.

• Go to the E-BRC section: From the “Services” tab, choose E-BRC in DGFT.

• IRM access repository: See all the IRM messages loaded by your bank.

• IRM link to shipping invoices align the IRM messages with the corresponding invoices or the Softex forms.

• Create E-BRC: Click “Generate E-BR” and verify the information.

• Follow and compliance state: If a bank raises a red flag in your bank completion certificate, add more information if necessary.

When doing this, exporters can conveniently handle their export documentation through the DGFT portal.

Workflow of the new updated E-BRC system

The new updated system is based on electronic messages of internal remittances (IRMS). This means that every time your bank receives an amount of export remittances, it generates an IRM message for that amount.

According to the new system, the bank will electronically load this IRM message on the DGFT website. Now, as an exporter, when you log in to the DGFT portal, these IRM messages will be shown. Then you must link these IRMs with your shipping invoices, invoices, softx, etc., and generate your own E-BRC.

You can also multiple IRM clubs and link them to a single shipping bill, which means that it can generate a single e-BRC from multiple IRM. In addition, you can divide a single IRM into multiple E-BRC and can be generated for exports of goods, exports of services and exports considered.

When an e-BRC is self-ocertified and generated, the data for all these e-BRC will also be sent to the bank. If the bank has any questions, you can mark the E-BRC and request additional clarification of you. Another useful feature presented by DGFT is that if an e-BRC is not used after being issued, it can be canceled in case of any error made during its generation.

See the video below to understand the process step by step of the EBRC generation on the DGFT website. In this video, we will guide it through the live process of how to generate E-BRC using this new method on the DGFT portal.

https://www.youtube.com/watch?v=curj5npf2uw

Implementation timeline: When can exporters start using it?

The soft release of this new system for banks has already begun on November 15, 2023.

But the question is, when will it begin for exporters?

For exporters, the start date will depend on the bank they use. According to commercial notification, after completing the incorporation process, each bank will provide its deadline. After this deadline, banks will begin to load IRMS on the DGFT website.

As soon as banks begin to load IRMS on the DGFT website, exporters can also start self-autrtifying and generating E-BRC. Therefore, exporters must monitor the cutting dates provided by their banks, which can be done through the DGFT website. In addition, exporters must first select the E-BRC service on the DGFT website and then select “Incorporation / Incorporation of Banks”.

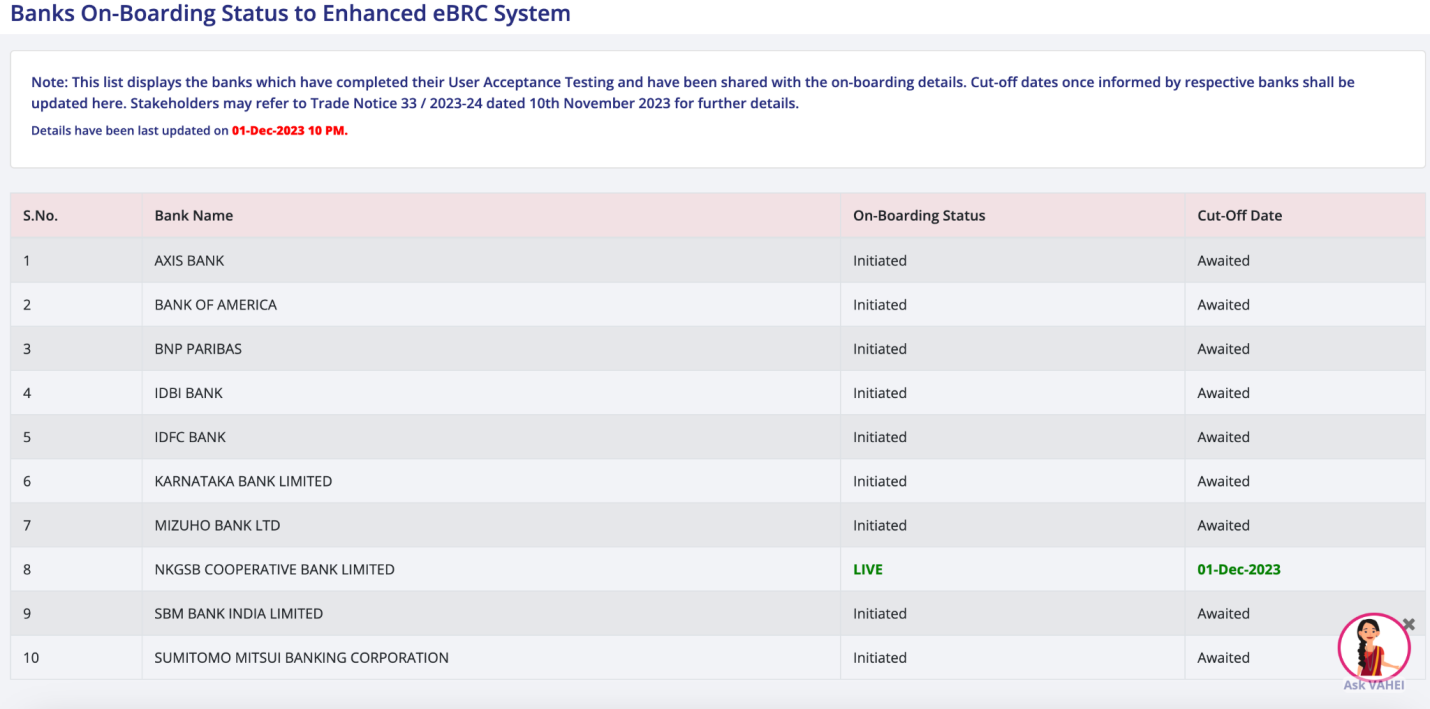

After the selection, a screen will appear, as shown in the image.

You can see in the image that NKGSB Cooperative Bank Limited is already in a live state and, as of December 1, 2023, it has been electronically transmitting all its IRMs to the DGFT website.

This means that for exporters using the services of this bank, if its internal remittances are received after December 1, 2023, they must self-fringe and issue their e-BRC. For remittances received before December 1, 2023, the Bank will generate the E-BRC using the traditional method.

Then, in summary, if the SMF is received after the deadline, the exporter will self-autrtify and generate the E-BRC. If the SMF is received before the deadline, the bank will issue the E-BRC through the previous traditional method.

Where and how to access the E-BRC generation system

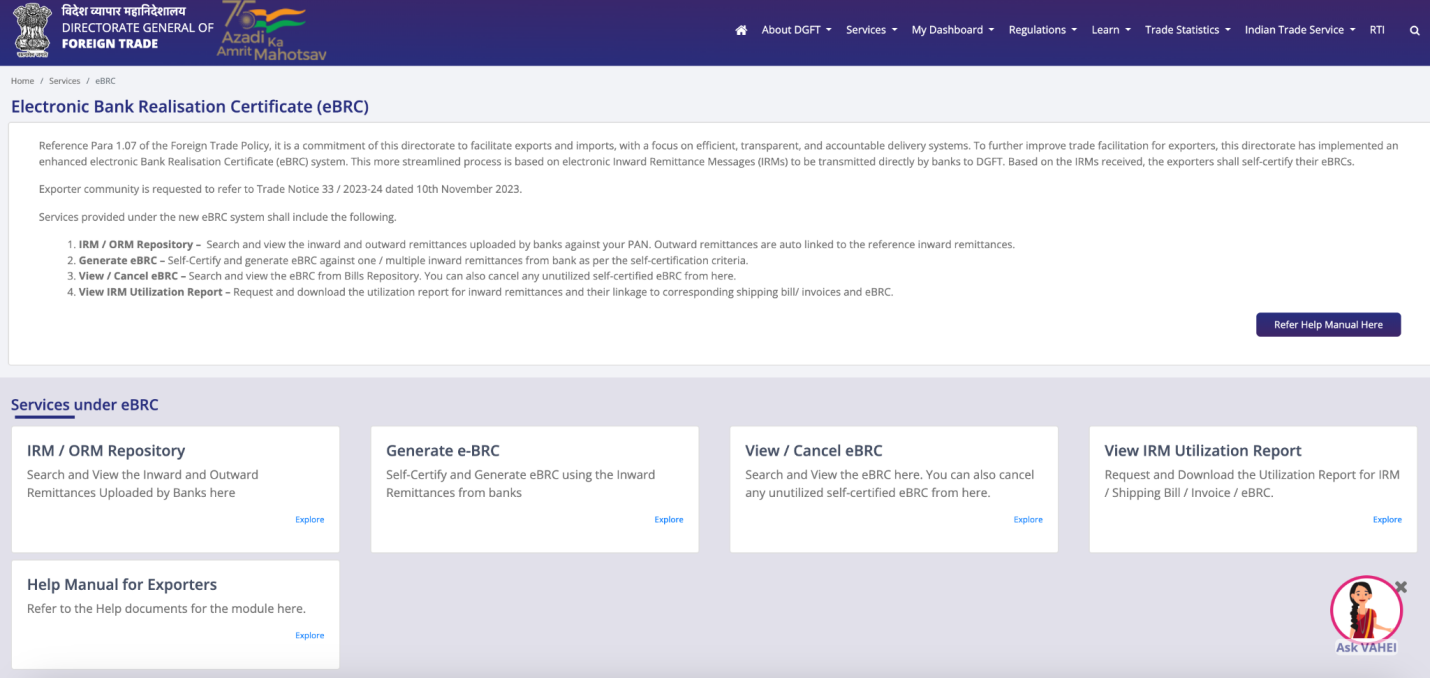

To self-autrtify and generate the E-BRC according to the new system, you must go to the DGFT website. In the “Services” tab, select the last option, which is “E-BRC”.

A screen will open, as shown in the image.

- Here, you can see that there are several options available. The first option is the MRI repository, where you will find details of all the IRMs transmitted by the banks.

- The second option is to generate E-BRC, where you can generate an e-BRC using the IRMS available.

- Then, there are options to see/cancel the unused autocertified E-BRC, see the IRM use report, etc.

Key rules for E-BRC generation: what exporters should know

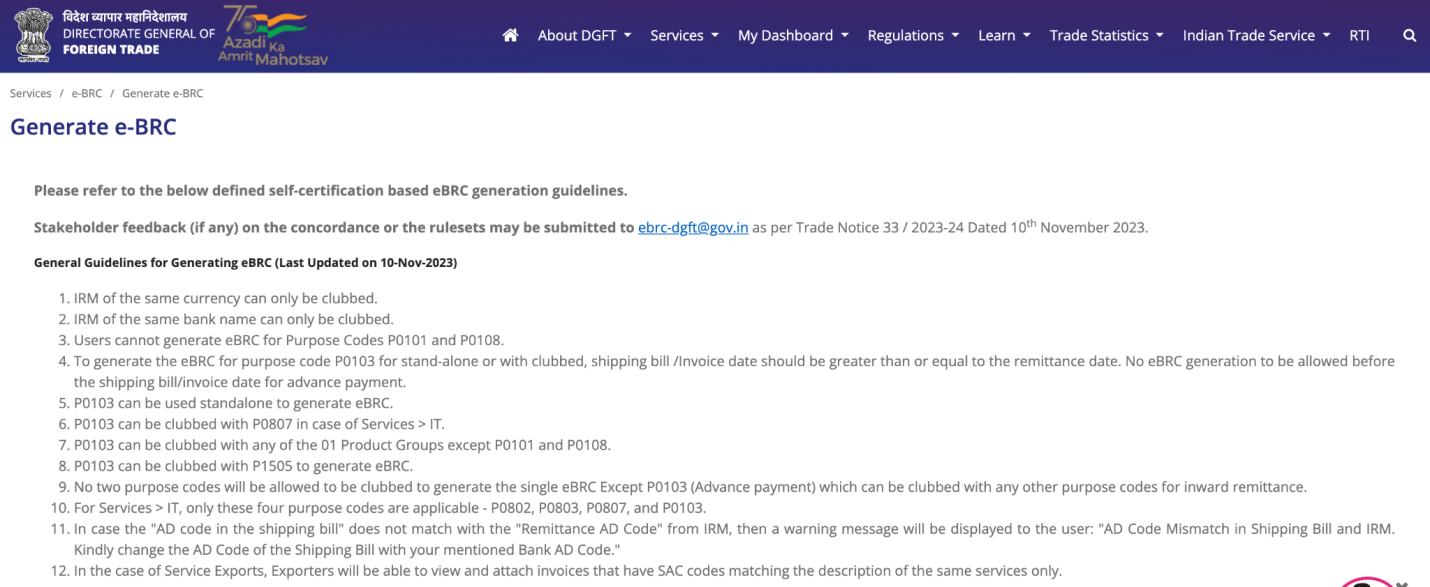

DGFT has specified the E-BRC generation rules in a section, which you can see in the image.

- Exporters must refer to this section regularly.

- Some of the main guidelines include that only IRM club of the same coin can, and only the IRMs of the same bank can be covered.

- In addition, detailed guidelines have been provided based on different purpose codes.

- In general, it is now the responsibility of exporters to generate E-BRC, and must ensure that mistakes are not made in this process.

- This is a new system that has been launched, and many more changes will come in the future. If, as an exporter, you want to share any comments or difficulty, you must send an email e-Brc-dgft@gov.in.

[Not sure whether your company is taking all the Export incentives notified by the Govt? – Refer to our article on “18 latest Export promotion schemes/Export Incentives in India“]

Typical problems and solutions in E-BRC self-finish

Although the new E-BRC generation process is simpler, exporters can face problems such as:

- IRM messages are not found on the DGFT portal:

Solution: Make sure your bank has uploaded them according to the DGFT commercial notification.

Solution: Obtain the correct corrected details of your bank before creating E-BRC.

- Bank flags to autocertified E-BRC:

Solution: Send the appropriate export documentation to overcome marking.

- Created by E-BRC error:

Solution: Use the cancellation option for E-BRC not used in DGFT.

The awareness of these difficulties guarantees an easy implementation of customs compliance and foreign trade policy.

Legal and compliance implications of the E-BRC generation

- Exporters must adhere to DGFT commercial notification guidelines while creating the bank completion certificate.

- All records must be kept for a minimum of five years for the fulfillment of the audit and customs.

- Incorrect E-BRC in DGFT inputs can cause export incentives delays.

- DGFT can bring new updates, therefore, exporters must remain updated on changes in foreign trade policy.

How AFOO Group can simplify your e-BRC process

AFOO Group is a specialized company that meets all export and import needs. We provide DGFT and Customs Consulting Services, they are specialized in the load forward and also deal with the purchase/sale of Canon/ROSCTL/DFIA licenses.

We have guided many new exporters and importers from the beginning, helping them execute their export/import shipments and help them with DGFT, Customs, Banking, Logistics, Export Incentives and Legal Affairs.

We are currently handling the EBRC generation work of more than 500 companies, which have been subcontracted to us. We can also help you with EBRC generation. Then, in the case of any requirement, complete the form below or can call us or send us an email directly.

Frequent questions in the updated DGFT E-BRC system

#Faster #smarter #problems #exporters