What is Icegate?

Indian Customs Electronic Gateway (Icegate) is the National Portal of Indian Customs governed by the Central Board of Indirect and Customs Taxes (CBIC). It is an online portal that provides commerce electronic filling services, cargo carriers and other electronically commercial partners. Currently 304,894 users are registered in Icegate.

Icegate is a centralized portal that allows the electronic presentation of crucial documents, such as entry invoices, shipping invoices and other documents necessary for the authorization of imported and exported goods. This digitalization optimizes customs operations, ensuring a perfect process without errors for companies and the customs department.

For anyone involved in the import-export business, Icegate’s understanding is vital, since it facilitates customs authorization, tax payments and compliance with legal requirements. By offering real -time monitoring and integration with key government systems such as DGFT and GSTN, Icegate improves efficiency and helps reduce the risk of errors and sanctions.

Key Icegate benefits for importers and exporters

The Icegate portal provides several benefits to exporters and importers by making the electronic presentation easier and more efficient in terms of trade. Some of the main advantages are:

• ICAGATE translates into a faster disposal of shipments through the exchange of electronic data with the customs department.

• Less paperwork with a system of shipping online documents.

• Real time monitoring of the shipping bill and the input invoice for instant updates.

• Integration with other commercial facilitation systems such as DGFT and ICEGATE Personalized for soft operations.

• Insurance presentation services to present import and export documents.

• Availability 24/7, where customs officers and merchants can use the system at any time.

Who can register in Icegate?

At the time of the Icegate registration, users must choose their role, and this defines their level of access and services they can use. The broad categories are:

• Exporters and importers: They can send and monitor their shipping invoice and electronically input invoice.

• Customs officials: Get access to internal systems for authorization and inspection.

• Logistics partners: Understand carriers and cargo carriers that handle transport -related procedures.

• Electronic commerce merchants: They can use the ICAGATE electronic commerce portal for electronic transactions.

All parties take advantage of the presentation services and electronic tools provided by Icegate, rationalizing international trade.

Solution of problems of common problems in Icegate

While Icegate offers a perfect digital platform, users can face some challenges, such as:

• Registration problems: New users can have difficulties with the ICAGATE registration. Solution: Follow the correct procedure using the link on the home page to obtain guidance.

• Document load errors: Some users find difficulties when loading an online document. Solution: Make sure the files are in the correct format and meet the size requirements.

• System inactivity time: Periodic maintenance can maintain operations. Solution: Check the updates on the Icegate portal or take advantage of the anterior ICAGATE electronic commerce link when necessary.

Icegate 2.0: What’s new and improved?

The Central Special Taxes Board and CBIC continues to improve Icegate’s electronic commerce facilities. Some of the recent improvements are:

• ICEGATE 2.0 IMPLEMENTATION TO IMPROVE THE SYSTEM SPEED AND THE USER INTERFACE.

• Improvement of ICAGATE personalized services to cover more commercial categories.

• Commerce gateway updates, incorporating AI for faster processing.

• Innovative security characteristics to safeguard electronic data exchange transactions.

It is anticipated that the improvements in the future will further improve the role of the export of Icegate in facilitation of business trade throughout India.

Migrate to icegate 2.0: what you need to know

General Directorate of Systems, CBIC has launched Icegate 2.0 Wef 16.11.2022. It will be launched gradually. Users will be hinted at several future modules in advance through emerging windows/tickers/notifications. Users will continue to use the existing icegate 1.0 characteristics and additional features in Icegate 2.0 to the complete deployment of the latter. ICAGATE optimizes trade by offering services such as digital document processing and customs facilitation under Indian customs.

ICAGATE applications can be accessed as follows:

Icegate 1.0: The user can access all existing modules and features from Icegate 1.0. As of November 16, 2022, the new link for the Icegate 1.0 website is https://old.icegate.gov.in. This link is also provided on the Icegate 2.0 website. Those users who cannot access ICEGATE 2.0 (because their presentation location is not made live in Icegate 2.0) will be able to access ICAGATE through the ICAGATE 1.0 application.

ICAGATE 2.0: Users can access existing functions, as well as new additional features of Icegate 2.0. Post was based on the climbing location live on November 16, 2022, ICAGATE 2.0 is accessed https://icegate.gov.in.

A step by step guide → How to register in Icegate: a complete guide

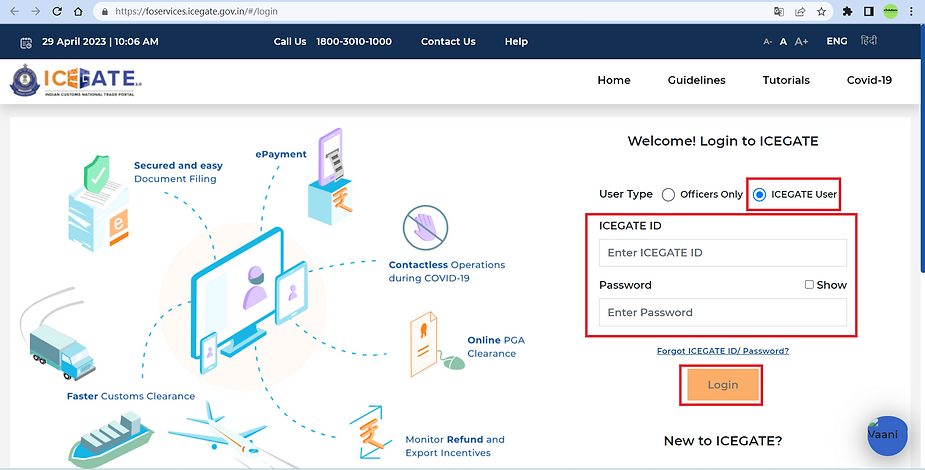

1. existing users- Existing ICAGATE users (that is, users already registered in ICAGATE1.0) are not obliged to obtain a new record. The user can log in directly by providing your ICAGATE and password ID without having to register again. In such cases, the ‘user type’ that must be selected will be ‘Icegate user’.

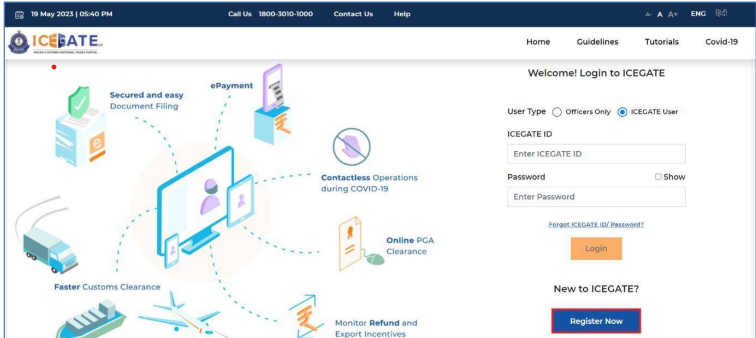

2. New record: For new records, click on the

Steps for the new registration for the importer/exporter:

Step 1: For the new/ new registration where reference ID is not generated, the user must click on the option ‘Fresh Registration: It does not have the reference ID option’.

If the user has a non -defeated reference ID, he/she must click on the option ‘Continue using the reference ID’.

Step 2: The system will show the set of options from which the user can select the required role (for example, importer, exporter, cha, etc.)

Step 3: Verify the details of GSTN and IEC valid for importers/exporters.

Step 4: Selection and verification of contact data that is email ID and mobile phone number generating OTPS

Step 5: After the validation of OTP, obtain a valid reference ID for 15 days.

Step 6: Choose proceed immediately or later with the roles registration using the reference ID.

Step 7: Filling Registration Form: Complete the organization and authorized details of the user and load the necessary documents. Save the form as a draft if necessary.

Step 8: Send record

[To know more about ICEGATE registration, you may refer to our article here – Icegate Registration Online – How to Register, Complete Process & Documents required]

For the ICAGATE registration, an importer or exporter must send the following documents:

Bread card, Import Export Code (IEC)Assets and services identification number (GSTIN), Class III Digital Signature (DSC), Identity and Address Testing (for example, AADHAR Card, Passport, etc.) and Authorization Letter

Essential services available in Icegate

ICAGATE contributes collectively to simplify customs procedures, improve trade facilitation and promote transparency and efficiency in cross -border commercial activities in India by providing multiple services for its users, including importers and exporters, commercial partners and cargo carriers.

- Online payment of customs duty

- Presentation of the entrance invoice, shipping invoice, General Manifest Import (IGM) and the General Export Manifesto (EGM)

- Loading the necessary support documents through Eschit allows faster and faster processes that reduce paperwork

- Incentives through scrips are used through Icegate

- The installation of the custom tax calculator

- Exchange rate notifications are available in Icegate

- IEC and GSTN integration

- The 24×7 aid service installation is available in Icegate

[To know more about the AD code & IFSC registration, you may refer to our article here – Icegate AD Code Registration]

The future of digital customs with Icegate

Released in 2004, Icegate has continually evolved to meet the needs of the commercial community. The Central Board of Indirect and Customs Taxes (CBIC) undertakes to further improve the platform, with numerous future initiatives designed to improve the experience for importers and exporters. As Icegate progresses, it will provide even more advanced tools and characteristics to admit efficient customs operations and regulatory compliance. The Simplify Platform Simplifies key processes, such as presenting online for commercial documents, presentation of the entrance invoice for customs authorization and payment without problems of customs duty through digital channels, reducing delays and improving efficiency.

Conclusion

Icegate has revolutionized the face of the facilitation of customs and commerce of India by offering a digital gateway without problems for importers, exporters and other parts. Through constant improvements, such as Icegate 2.0, the portal will become increasingly efficient, with greater speed, safety and connectivity to the main government systems. Companies can also benefit from the 24×7 aid service installation, ensuring a rapid consultation resolution. In addition, tools such as documents monitoring in Customs EDI online improve transparency, while submission services simplify compliance with international trade. As international trade grows, Icegate will have an increasingly important role to perform in the simplification of customs procedures, minimizing documentation and following regulatory guidelines. For international trade companies, it is essential to maintain the pace of ICAGATE capacities and improvements for transactions without problems and without problems.

Do you have doubts? Complete the following form to contact us.

Notice: Javascript is necessary for this content.

#website #registration #process #services #offered