You can use the general rules to determine which percentage to versus bonds. As “60 percent of shares and 40 percent to bonds”.

You can use the general rules to determine which percentage to versus bonds. As “60 percent of shares and 40 percent to bonds”.

But the laureate Nobel Robert Merton developed a formula to which he can use calculate An “merton participation” or optimal assignment to actions. The Merton Share estimator then makes this calculation.

Note: The instructions and additional information appear below the calculator.

Merton Share estimator instructions

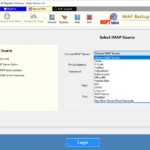

The merton shares estimator requires five entries to calculate how much you or I must assign the shares: capital yield, standard capital deviation, risk without risks, standard risk -free deviation and constant aversion of relative risk.

You ought Being able to obtain the necessary estimates of the yield rates of the Financial Services Company that have their 401 (K) or individual retirement account. These companies also generally provide a volatility measure, which is the standard deviation.

Three tips here. First, if you have invested different kinds of capital with different expected yields? For example, if its Variable Income Assignment invests 50 percent in US shares. Uu. It is expected that three percent and 50% are expected to be Americans that are expected to win five percent? Calculate an average weighted yield equal to four percent for combined actions. For example:

50% * 3% + 50% * 5% = 4% weighted average yield

A second advice: adjust inflation and work with real returns. This approach allows you to use the rates of values protected by treasure inflation (tips) as risk -free performance. To adjust nominal capital returns for inflation, only subtract the inflation rate. For example, a six percent nominal capital yield is equivalent to real four percent yield if inflation is equal to two percent. For example:

6% nominal yield – 2% inflation = 4% real return

A third advice: You can probably use historical standard deviations for your calculations. At least to start. Sometimes people say that the standard deviation equals approximately 15%. Sometimes 20%. But an online tool like Portfolio Visualizer allows you to calculate the real standard deviation of combined shares. In addition, the CBOE Vix index shows the expected standard deviation in expected US actions during the month. (You can google to obtain the most recent VX value).

Understand the calculations of the Merton Share estimator

A single formula calculates the part of Merton. And that formula basically divides the equity premium by standard deviation to the square or variance of the actions. So:

Equity Premium / Standard Deviation^2 = Capital Assignment

For example, in a simple case where shares return two percent more than investments without risks and the standard deviation is equal to twenty percent? The formula could make this calculation and return .5, or 50%, indicating an assignment of 50 percent to shares. Here is the formula:

2% Equity Premium / (20% standard deviation ^2) = 50% capital allocation

But in practice, it is a bit more complicated. So let me fall through the rabbit burrow for just a few prayers.

Nitty Share Share Share Estimator Details

To calculate the equity premium, the calculator assumes that the expected, real, has entered geometric average return of the actions and the expected, real, geometric Average risk of risk -free bonds (such as values protected by treasure inflation) together with the expected standard deviations of these two investment options. (When a financial services company such as Vanguard, Blackrock or Fidelity estimates that the performance you or I could gain actions or bonds for a decade. That is a geometric average or average. It can also be nominal including inflation. Or real, then balanced for inflation).

The calculator then estimates the real, arithmeticAverage return of shares and bonds without risks, and the difference between the two, which is the capital premium. (To make this estimate, the calculator uses a common but imprecise adjustment: add half of the variance, or the standard deviation squared by two, to the geometric return).

To determine the appropriate allocation to the actions, the calculator makes that simple division operation. But with another adjustment, this of Professor Meton. The formula is actually divided by the equity premium by the standard deviation to the square, or the variance, times the constant entry of relative risk aversion. Thus, the real formula looks like this:

Equity Premium / (standard deviation^2*Constant relative risk aversion)

The “constant” allows people to assume different risk aversions. Research suggests that many people have constant relative risk aversion equal to 2, a level that suggests some risk aversion. And the common range of constants works from 1 (low -risk aversion) to 5 (high -risk aversion). What is it worth? I believe that my personal relative risk aversion is equal to 1 or 2. The relative risk aversion of most people is equal to 2 or 3.

Note: Anyone who is neutral in the risk or almost like that? Its constant of relative risk aversion is perhaps equal to 0. And in this case, they ignore the risk and focus only on the expected performance.

Observations on manufacturing Merton Shares estimator

Some rapid observations on making merton share the calculations. And about the use of calculation results to make better decisions.

First, the calculations suggest that we must often be at risk than us. Not always, no. And perhaps not at the time I write this in December 2024, but people should generally assume more risk to obtain expected higher returns.

A second point: The calculations of the Merton shares estimator suggest that currently (late 2024) an intelligent way to reduce the risk of US investors is to invest more widely than only in US actions. If model investing half in the US shares. And half in international actions, for example, the calculator perhaps suggests an assignment of 70 percent to shares for an average risks aversion investor. If model only investing in US actions? It suggests less than an assignment of 40 to the shares for a low -risk aversion investor and an allocation of 20 to the shares for an average risk aversion investor.

Third, and this is personal and anecdotal … But I suspect that the more we experience with the calculations of Merton Share? And the more you or I have rooted it to update the expected yields and standard deviations for actions and bonds? Yes. Well. I think that can turn off your constant relative risk aversion. Therefore, be careful.

Other resources

The publication of the super safe retirement rate provides a complementary discussion and another calculator: Super safe withdrawal rate calculator.

Professor Meton’s research work appears here: Life portfolio selection under uncertainty: the continuous time case

The authors of the book, “The Falling Billionars”, use Merton’s participation in their wealth advice. Many interesting ideas appear on your website, including this: The man does not invest only by profits. By the way, “missing billionaires” is dense but a very Read interesting.

#Merton #Shares #Estimator #Evergreen #Small #Business